In UK accounting terms, debtors represent amounts owed to a company by customers, businesses, or individuals, typically for goods or services sold on credit. They're a bit like IOUs, but without the fun of a handwritten note.

Since these future payments will eventually make their way into your bank account (we hope!), debtors sit under your company’s current assets on the balance sheet. They're a reminder that cash is on its way—just not yet.

So, whether you’re chasing payments or just watching your assets grow, understanding where debtors fit into your balance sheet is essential for keeping your financial health in tip-top shape. After all, those future cash inflows are the lifeblood of your business, even if they do take their sweet time arriving!

What exactly are debtors?

They're basically the people who owe you money, like that friend who "forgets" to pay you back after dinner! In the world of accounting, these folks are called accounts receivable—a fancy way of saying, "Hey, they’ll pay up... eventually."

Why should you care about debtors? Well, if you don’t keep track of who owes you, your cash flow could get messier than a toddler with spaghetti. Managing debtors properly means you get paid on time, keep your business running smoothly, and avoid those awkward "Hey, you still owe me" moments.

And since we’re talking about UK accounting practices, we’ll dive into how businesses in the UK handle all this debtor stuff—so you can keep your accounts as tidy as a well-organized tea party!

Now that we understand what debtors are and how they arise, let's take a closer look at how they are recorded on the balance sheet and why they are classified as part of a company’s current assets.

Debtors on the balance sheet

Debtors, or accounts receivable, are typically split into two main categories based on when the company expects to collect the money:

- Debtors due within one year: These are amounts the company anticipates collecting within the next 12 months. Since this money is expected to be received in the short term, these debtors are classified as current assets on the balance sheet. They play a key role in a company’s day-to-day liquidity, ensuring that cash will be available to cover operating costs like salaries, supplier payments, and other short-term obligations.

- Debtors due after more than one year: Sometimes, companies may have receivables that will be collected over a longer period—beyond 12 months. Even though the cash will take longer to arrive, these amounts are still classified as current assets under UK accounting rules. Why? Because they still represent future cash inflows, which are crucial for long-term financial planning and stability.

This distinction between short- and long-term debtors helps analysts and stakeholders evaluate a company’s cash flow. It provides insight into both the immediate and future inflows of cash, helping to assess how well the company can meet its financial obligations and continue growing. Tracking when debtors are likely to pay up is especially important for ensuring that a business can stay on top of its expenses without needing to rely on external financing.

Example of debtors classification

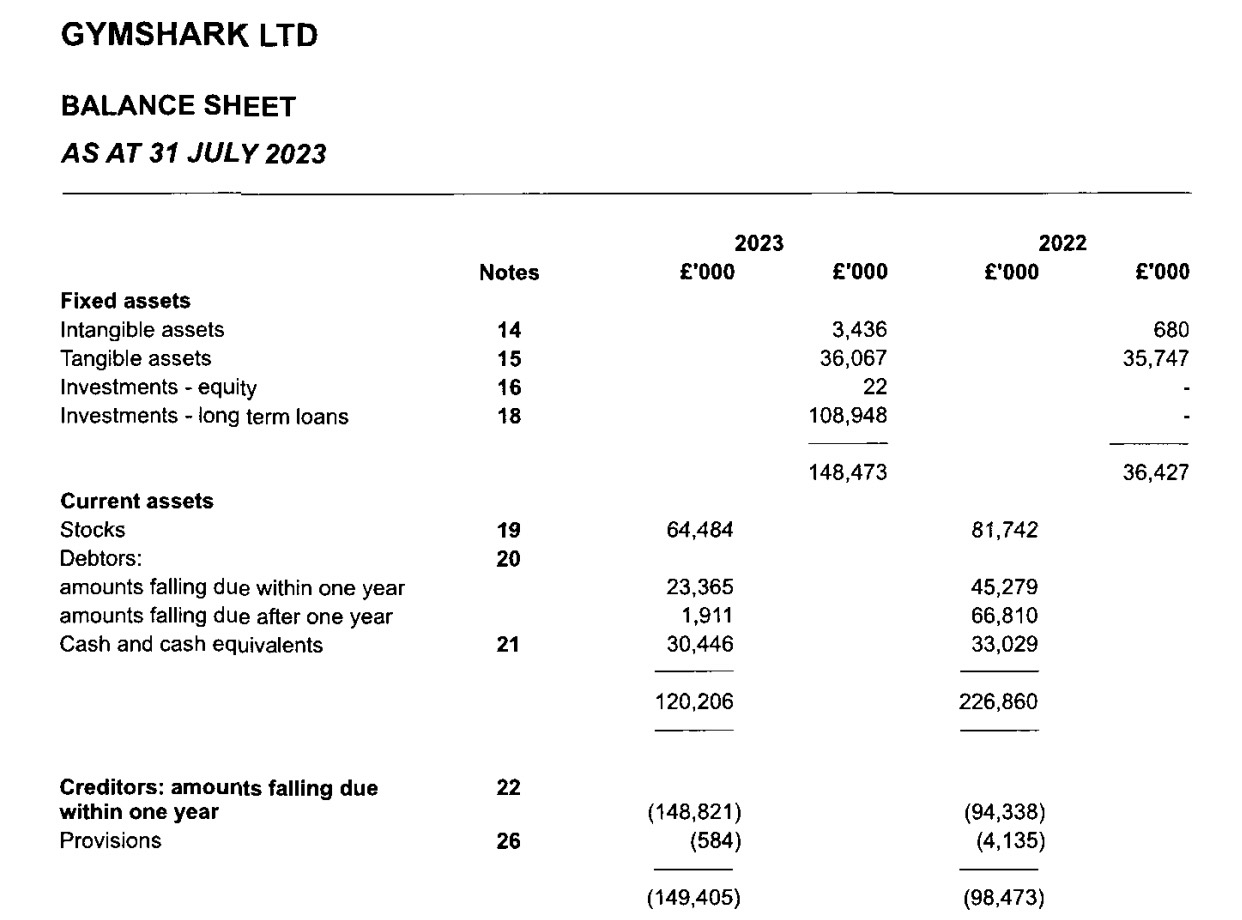

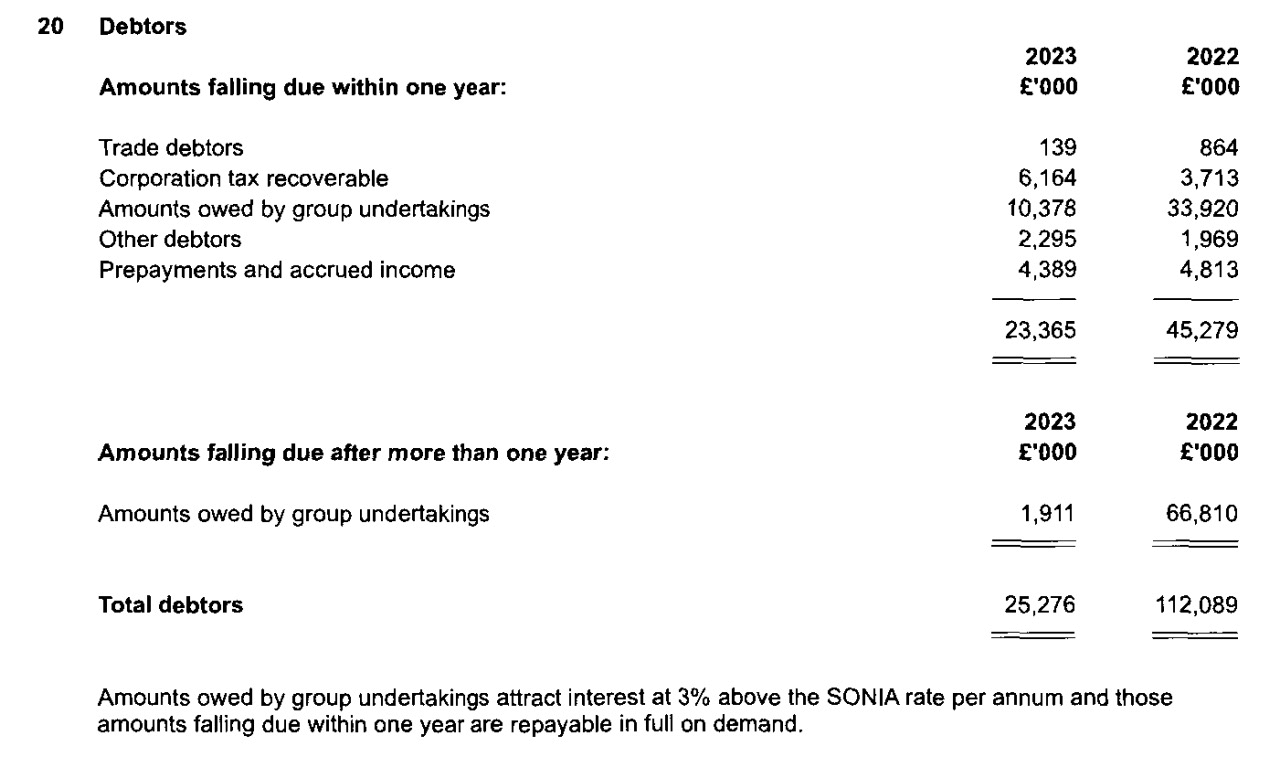

Let’s take GymShark Ltd as an example to see how debtors are presented in real-world financial statements. In their financial statements (Note 20), GymShark Ltd reported £23,365,000 in short-term debtors. This amount includes trade debtors (money owed by customers for goods or services sold), recoverable corporation tax (taxes the company expects to get back), and amounts owed by group undertakings (companies within the same corporate group).

Interestingly, the amounts owed by these group undertakings attract interest at 3% above the SONIA rate (Sterling Overnight Index Average). SONIA is a benchmark interest rate used in the British sterling market and reflects the average rate at which banks lend to each other overnight. So, GymShark earns a bit of extra income on these amounts, thanks to the interest arrangement. Additionally, these group debts are repayable on demand, meaning GymShark can call in the money whenever needed, which helps boost the company’s short-term liquidity.

On the long-term debtors side, GymShark also reported £1,911,000, which is expected to be received after more than one year, again from group undertakings. This enhances the company's long-term liquidity planning, providing GymShark with a clear picture of future cash inflows to support ongoing growth and operational stability.

By analyzing both short- and long-term debtors, we can see how GymShark manages its receivables not only to maintain daily cash flow but also to secure future financial health.

Why are debtors due after more than one year classified as current assets?

It might seem odd that debtors expected to pay after more than a year are still classified as current assets—wouldn't they fit better under non-current assets? The answer lies in UK accounting standards, specifically (SI 2008/410) , which treat these amounts as current assets because they represent future cash inflows that the company will eventually receive, even if it takes a bit longer.

The key reason for this classification is that these receivables are still considered part of the company’s working capital. Working capital refers to the resources a company has to fund its day-to-day operations, like paying suppliers, covering employee wages, or managing inventory. Even though the cash won’t come in immediately, it is still money the business expects to use to support its ongoing operations in the future. Excluding them as current assets could lead to a misinterpretation of the balance sheet.

This is different from non-current assets, such as long-term investments or fixed assets like property and equipment, which aren’t meant to be converted into cash within a year. Debtors, on the other hand, represent money that will eventually make its way into the company's accounts, helping sustain operations over time, and that’s why they’re kept under current assets on the balance sheet.

By classifying even long-term debtors as current, UK accounting standards ensure that businesses and stakeholders have a clear picture of all future cash inflows that will help maintain the company’s liquidity and financial flexibility.

Example: Debtors of GymShark

According to GymShark’s notes to the financial statements, the £1,911,000 owed after more than one year comes from group undertakings—essentially, intercompany debt. This means the debt is between companies within the same corporate group, making the classification more straightforward. GymShark expects to recover this amount, but it will take longer than 12 months to receive the full payment.

Even though it’s a long-term receivable, this type of debt is still crucial for cash flow management. It provides GymShark with a predictable source of future income, allowing the company to plan ahead and ensure they’ll have cash available down the line. This predictability is one of the reasons why these long-term debtors are classified as current assets. While they won’t be converted into cash immediately, they are still part of the company’s working capital and will eventually contribute to ongoing operations.

By classifying them as current assets, GymShark’s balance sheet accurately reflects all expected future inflows that will help the business maintain its liquidity, even beyond the short term. This treatment also highlights the importance of intercompany debt in long-term financial planning, as it provides a reliable source of cash without the uncertainties typically associated with third-party debtors.

Importance of separating short-term and long-term debtors

Breaking debtors down into those due within one year and those due after more than one year is important for several reasons:

- Assessing liquidity: Short-term debtors help the company's liquidity because they will bring in cash soon. Long-term debtors don't help as much with immediate liquidity but are still expected to be paid in the future. This division helps people see how easily the company can meet its short-term financial obligations.

- Cash flow planning: The timing of when the company expects to collect payments is key to understanding its cash flow. Knowing which debtors will be collected soon and which will take longer helps the company plan for future cash needs and payments.

- Managing risk: Long-term debtors carry more risk because the longer the company has to wait for payment, the more likely something might go wrong (like a customer not being able to pay). Separating these amounts helps people assess how much risk the company is exposed to in terms of waiting for long-term payments.

- Working capital management: Short-term debtors are a major part of the company's working capital, which is the money the business uses to run its daily operations. Managing debtors efficiently can improve the company's ability to meet its financial obligations and operate smoothly.

Breaking down debtors into short-term (due within one year) and long-term (due after more than one year) categories is essential for several key reasons:

- Assessing liquidity: Short-term debtors are crucial for a company's immediate liquidity because they will bring in cash relatively soon, helping the company meet short-term obligations like paying suppliers or covering operational expenses. On the other hand, long-term debtors don't provide the same immediate cash benefit but are still valuable future assets. This separation allows stakeholders to clearly assess how easily the company can meet its upcoming financial commitments.

- Cash flow planning: Understanding the timing of payments is vital for cash flow management. By separating debtors based on when the cash is expected to come in, the company can plan for its future cash needs more effectively. Knowing which payments will arrive soon versus those that are further down the line helps the company make informed decisions about spending, investments, and managing other liabilities.

- Managing risk: Long-term debtors generally carry higher risk compared to short-term ones. The longer a company has to wait for payment, the more chances there are that something might go wrong, such as a customer facing financial difficulties and being unable to pay. By separating short- and long-term debtors, companies and analysts can better assess the risk exposure associated with longer payment periods and make provisions if necessary.

- Working capital management: Short-term debtors play a critical role in a company’s working capital—the funds used to run daily operations. Efficiently managing these short-term receivables ensures that the company has the liquidity it needs to operate smoothly, cover expenses, and invest in growth opportunities. Long-term debtors, while not immediately part of daily working capital, still factor into broader financial planning.

By clearly distinguishing between short- and long-term debtors, companies can maintain a healthy balance between managing immediate liquidity needs and ensuring long-term financial stability. This separation helps with smarter financial planning and reduces the risks associated with delayed payments.

Example: Debtors in One Call Insurance Services Limited

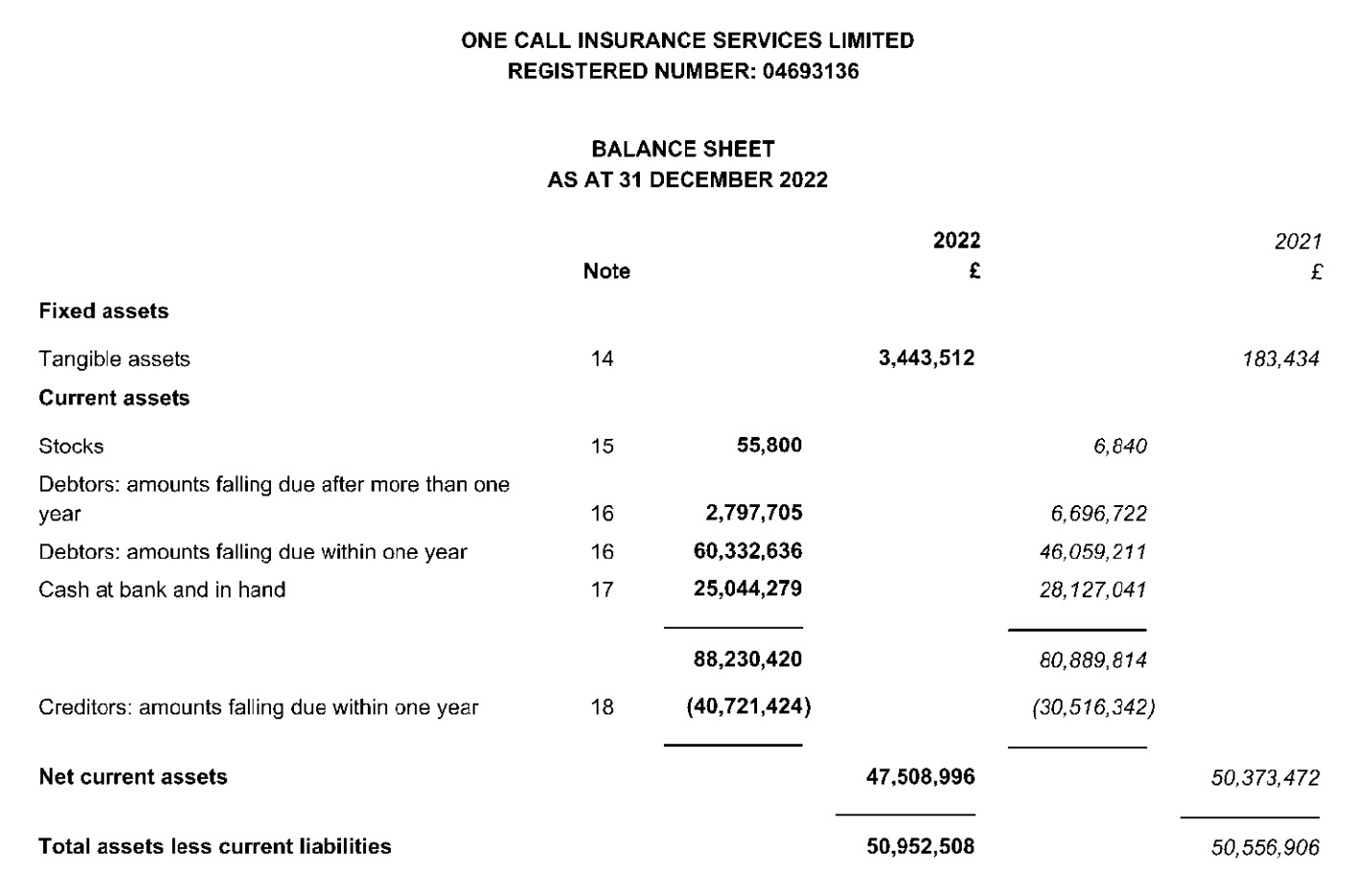

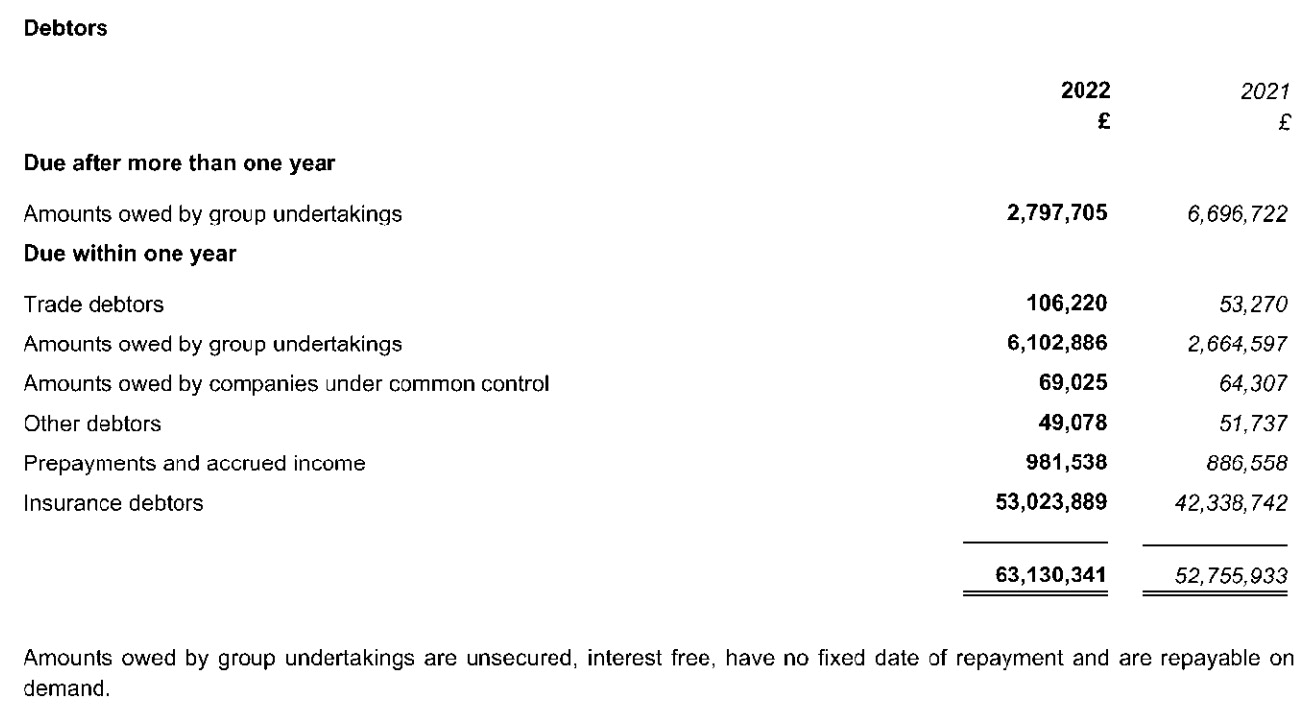

One Call Insurance Services Limited, an insurance provider, reported a total of £63,130,341 in debtors on its balance sheet as of 31 December 2022.

The Notes to the financial statements provide further details about the composition of these debtors.

The breakdown of debtors is categorized into several key types:

- Trade debtors: £106,220 – These are amounts owed by customers who have received insurance services on credit but have not yet paid. Essentially, this represents unpaid bills for services already provided.

- Intercompany debtors: £6,102,886 – This refers to the amounts owed by group undertakings, meaning other companies within the same corporate group owe money to One Call Insurance Services Limited. These intercompany transactions are common in large organizations where multiple entities operate under one umbrella.

- Insurance debtors: £53,023,889 – This category is specific to the insurance industry and represents amounts owed by policyholders or other parties related to insurance contracts. These might include premiums that have not yet been paid or amounts due from reinsurers.

- Prepayments and accrued income: £981,538 – Prepayments refer to payments made in advance for services the company has not yet received (for example, paying for a service contract that will start later). Accrued income refers to income that has been earned but not yet invoiced, meaning the company is waiting to bill the customer for services or products already delivered.

Each of these categories plays an important role in showing the company's receivables and helping stakeholders understand the sources of future cash inflows. Breaking them down provides a clear picture of who owes what and helps the company manage its cash flow more effectively.

UK companies’ reporting of long-term debtors

In the UK, companies are required to adhere to specific regulations regarding how they report debtors in their financial statements. These guidelines, outlined in the Companies Act 2006 and SI 2008/410, are designed to ensure transparency, allowing stakeholders—such as investors, creditors, and analysts—to easily assess the company's cash flow and liquidity.

When long-term debtors represent a significant portion of a company’s total assets, it is crucial to disclose this information clearly. Companies must either include this information directly on the balance sheet or provide detailed explanations in the notes accompanying the financial statements. This disclosure is important because it helps stakeholders understand how much of the company’s value is tied up in amounts that are expected to be collected over an extended period.

By following these reporting requirements, companies provide a clearer picture of their financial health and cash management practices, enabling better decision-making for all parties involved. This approach fosters trust and confidence among stakeholders, as they can see how effectively a company manages its receivables and plans for future cash inflows.

FRS 102 and debtor disclosure

The Financial Reporting Standard (FRS) 102, which is commonly used by many small and medium-sized businesses in the UK, mandates that companies provide detailed information about their debtors. Typically, this information is included as a note in the financial accounts. However, if the amount of debtors expected to be received after more than one year is substantial enough to potentially impact perceptions of the company’s financial health, it should be reported directly on the balance sheet.

This requirement helps paint a clearer picture of the company’s financial situation, distinguishing between amounts that will be received soon and those that will take longer to materialize.

Why this matters for investors and creditors

Understanding how debtors are reported is vital for anyone analyzing a company's financial health. Investors, creditors, and other stakeholders need to know:

- Expected receivables: How much money the company anticipates receiving in the near future.

- Timing of payments: When the company expects to receive those funds.

- Liquidity position: Whether the company has sufficient liquidity to meet its short-term obligations.

By breaking down debtors into those due within one year and those due after more than one year, stakeholders can better assess the timing of future cash inflows. This clarity allows them to evaluate whether the company can comfortably cover its immediate expenses while also maintaining long-term financial stability. Overall, this reporting structure fosters greater transparency and helps stakeholders make more informed decisions.

The importance of tracking debtors for small businesses

For small businesses, effectively tracking and managing debtors is vital for maintaining a healthy cash flow. Here are some key strategies to consider:

- Invoicing: Timely and accurate invoicing is critical. Small businesses should implement a system to generate and send invoices promptly after delivering goods or services to avoid payment delays.

- Payment terms: Clearly communicate payment terms to customers at the outset. Consider offering incentives for early payments or imposing late payment fees to encourage timely settlements.

- Regular follow-ups: Establish a systematic process for following up on overdue payments. This may include sending reminders, making phone calls, or offering payment plans to customers facing difficulties.

- Use of accounting software: Many small businesses benefit from using accounting software to efficiently track invoices, monitor payment status, and generate aging reports for debtors.

- Cash flow forecasting: By accurately tracking debtors, small businesses can better forecast their cash flow, which is crucial for making informed business decisions and planning for future expenses.

- Credit control: Implement credit control procedures to assess the creditworthiness of new customers and establish appropriate credit limits, minimizing the risk of non-payment.

Conclusion

In UK accounting, debtors represent amounts owed to a company by other businesses, customers, or individuals. They are a vital part of a company's current assets, even if they are not expected to be collected for more than one year. This classification highlights their role in supporting the company's working capital, rather than being categorized as long-term investments.

When filing financial statements with Companies House, UK companies must carefully separate debtors into those due within one year and those due after more than one year. This practice helps provide a clearer picture of the company's liquidity and cash flow, enabling stakeholders to make informed decisions about the company's financial health.

FAQs

Q: What’s the difference between debtors and creditors?

Debtors are entities that owe money to a company, while creditors are entities to whom the company owes money. Debtors are recorded as assets on the balance sheet, representing future cash inflows, whereas creditors are liabilities, indicating future cash outflows. Managing the balance between debtors and creditors is essential for assessing net liabilities, an indicator of the company’s overall financial obligations after accounting for assets.

A trade creditor is a supplier that provides goods or services to a company but has not yet been paid, making them part of the company’s accounts payable (a current liability on the balance sheet). Managing trade creditors effectively involves balancing payment terms to avoid cash flow strain, maintaining good supplier relationships, and aligning creditor payments with debtor collections for steady cash flow. This coordination of debtors and creditors is essential for managing working capital and ensuring smooth business operations.

Q: Can individuals also be debtors?

Yes, individuals can also be debtors. Just like businesses, individuals can owe money to a company, financial institution, or another person. For example, if an individual takes out a loan, uses a credit card, or receives services on credit (such as a medical bill or utilities), they become a debtor until the owed amount is paid off. In accounting terms, individuals as debtors are recorded in a similar way to businesses, with the entity they owe money to recognizing them as a receivable or debtor on their balance sheet.

Q: How do debtors affect cash flow?

Debtors can significantly impact a company's cash flow, as they represent money that is owed but not yet received. When customers delay payment or fail to pay on time, the company may face a cash shortfall, even if sales are strong. This can create a gap between revenue recorded on the income statement and the actual cash available for day-to-day operations.

If a business has many outstanding debtors, its cash flow can become strained, making it harder to cover immediate expenses like salaries, rent, and supplier payments. Conversely, efficiently managing debtors—by enforcing credit terms, following up on overdue payments, and minimizing the time between invoicing and payment—can improve cash flow and ensure the business has enough liquidity to operate smoothly.

In essence, while debtors reflect potential income, they do not translate into immediate cash until the payments are collected.

Q: How companies report debtors in companies house filings?

When filing financial statements, UK companies must adhere to specific reporting rules, which include:

Separating debtors: Companies are required to categorize debtors into two groups: amounts due within one year and amounts due after more than one year.

Disclosure of long-term debtors: Any long-term debtors must be disclosed either directly on the face of the balance sheet or within the accompanying notes. This transparency is crucial for understanding the company’s overall asset structure.

Breakdown of debtors: Companies should provide a detailed breakdown of the types of debtors, including categories such as trade debtors (amounts owed by customers) and intercompany debtors (amounts owed by related group companies).

Q: Key considerations on tax implications for debtors

The management of debtors can have several tax implications that businesses should consider:

- VAT: For VAT-registered businesses, VAT is generally due on sales when the invoice is issued, not when the payment is received. This means companies may need to pay VAT to HMRC even before receiving payment from customers, which can impact cash flow.

- Corporation Tax: Bad debts—those deemed unlikely to be collected—can be written off and claimed as a deduction for corporation tax purposes, subject to specific conditions.

- Cash Accounting: Some small businesses may opt for the cash accounting scheme for VAT, where VAT is accounted for only when payment is received, rather than when invoices are issued. This can ease cash flow pressures for businesses with late-paying customers.

- Income Recognition: For tax purposes, income is generally recognized when earned, not necessarily when paid. This aligns with the accrual basis of accounting used in financial reporting and highlights the importance of tracking debtors accurately.

Understanding these tax implications is crucial for ensuring accurate financial reporting and compliance with tax regulations.