A company’s balance sheet offers a detailed snapshot of its financial health at a specific moment in time. This guide will break down the core sections of a balance sheet, explaining assets, liabilities, and shareholders' equity in a straightforward way, making it easier for you to assess any company's financial position.

What is a balance sheet?

A balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific moment in time. It lists the company’s assets (what it owns), liabilities (what it owes), and equity (the owners' stake in the company). The balance sheet follows the basic accounting equation:

Assets = Liabilities + Equity

This equation ensures that the balance sheet is balanced, showing how the company’s resources are financed—either through borrowing (liabilities) or through shareholders’ investments (equity).

Imagine a balance sheet like a scale, where one side represents what a company owns (its assets) and the other side represents how it got the money to buy those assets. The money comes from two sources: borrowing (liabilities) and investments from owners (equity). The scale needs to be balanced, meaning the total assets must always equal the total liabilities plus equity.

The balance sheet is essential for assessing a company’s financial health and is typically used alongside other financial statements, such as the profit and loss statement and the cash flow statement, to give a comprehensive view of a company’s performance and stability.

Is filing a balance sheet with Companies House required?

In the UK, all companies are required to file annual accounts with Companies House, but the level of detail varies based on the company's size.

Larger companies must submit comprehensive balance sheets that include detailed financial information.

Smaller companies, such as micro-entities and small companies, can file simplified accounts with reduced disclosures. For example, they may omit the profit and loss account from public filings while still submitting a balance sheet (with reduced disclosures).

The filing requirements, which are set to change in April 2025, depend on the company’s classification, which is determined by meeting two out of three criteria: turnover, balance sheet total, and number of employees.

Below is a summary of these requirements:

| Company Size | Criteria (Meet at least 2 of 3) | Balance Sheet Filing Requirements |

|---|---|---|

| Micro-Entities |

- Turnover: ≤ £632,000 - Balance Sheet Total: ≤ £316,000 - Employees: ≤ 10 |

Balance sheet is required (option for reduced disclosures) |

| Small Companies |

- Turnover: ≤ £10.2 million - Balance Sheet Total: ≤ £5.1 million - Employees: ≤ 50 |

Balance sheet is required (option for reduced disclosures) |

| Medium-Sized Companies |

- Turnover: ≤ £36 million - Balance Sheet Total: ≤ £18 million - Employees: ≤ 250 |

Full balance sheet required (some disclosure exemptions available, compared to large companies) along with a detailed breakdown of assets, liabilities, and equity. |

| Large Companies |

- Turnover: > £36 million - Balance Sheet Total: > £18 million - Employees: > 250 |

Full balance sheet required with detailed disclosures, including all key financial details. |

What are total assets?

Total Assets, sometimes simply called Assets, represent everything a company owns that has value and can be used to generate future economic benefits. These include:

- current assets - Assets expected to be used or converted into cash within one year. Like cash, inventory, and accounts receivable, and

- non-current assets, Assets that are held for longer than one year. Like buildings, machinery, and long-term investments.

In a company’s balance sheet, assets are shown on one side to represent the value of what the company owns. Assets are critical because they fuel the company's operations and future growth.

Total Assets = Current Assets + Non-Current Assets

- Formula: Total Assets = Current Assets + Non-Current Assets

- Alternate names: assets, resources

In the next sections, we’ll explore current assets and noncurrent assets in more detail.

What are current assets?

Definition of current assets

Current Assets are short-term assets that a company expects to convert into cash or use up within one year. These assets are essential for covering the company’s day-to-day operations and ensuring it can meet short-term financial obligations.

By maintaining sufficient current assets, a business ensures liquidity, allowing it to meet immediate expenses and settle short-term debts efficiently.

Total Current Assets = Cash + Stocks + Debtors

- Formula: Total Current Assets = Cash + Stocks + Debtors

- Alternate names: Short-term assets, liquid assets, working capital assets.

Components of current assets

Current assets can be divided into three main categories: cash and cash equivalents, debtors, and inventory. These components are critical for the company’s short-term financial health.

We’ll go through each of them.

Cash and cash equivalents

- Definition: Cash and cash equivalents are the liquid assets that a company can use immediately to cover expenses. These include cash held in bank accounts (cash at bank) and any physical cash on hand. In addition, cash equivalents are short-term investments that can be easily converted into cash, typically within three months or less, and with minimal risk of changes in value. Common examples of cash equivalents include Treasury bills, money market funds, and short-term government bonds.

- Alternate names: Cash at bank and in hand, liquid funds.

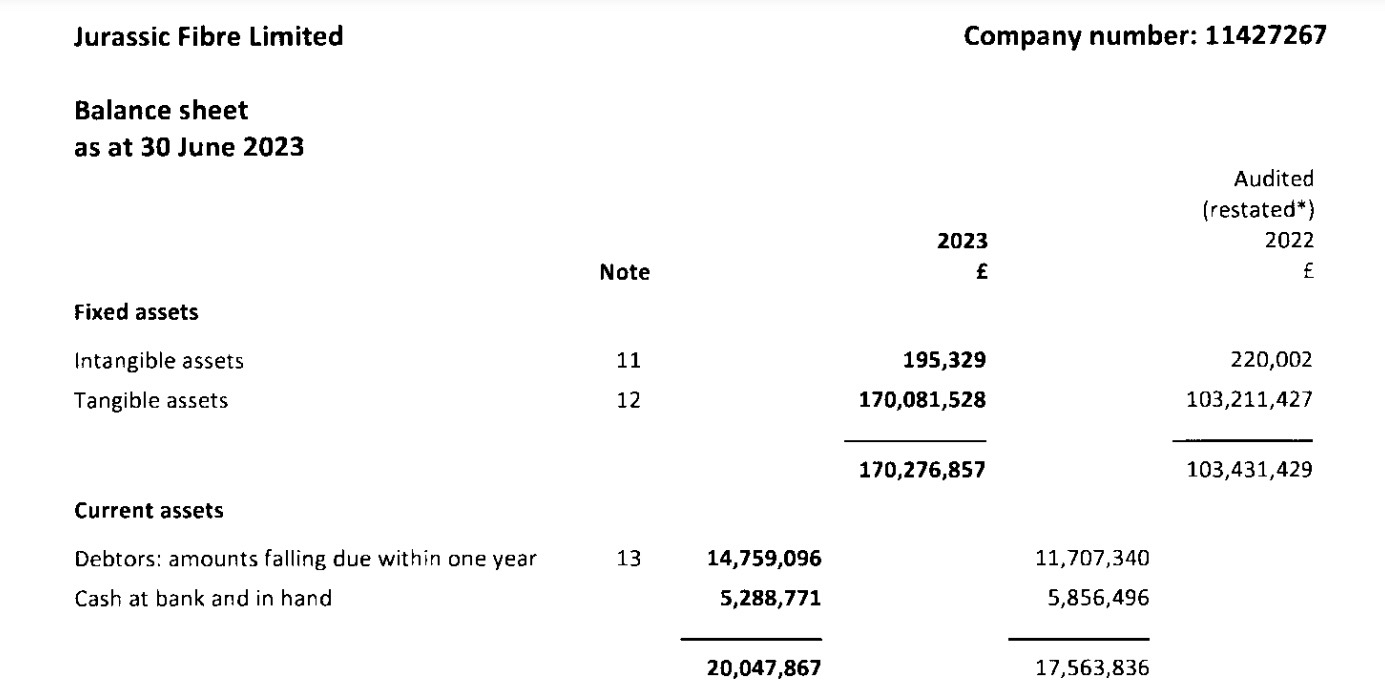

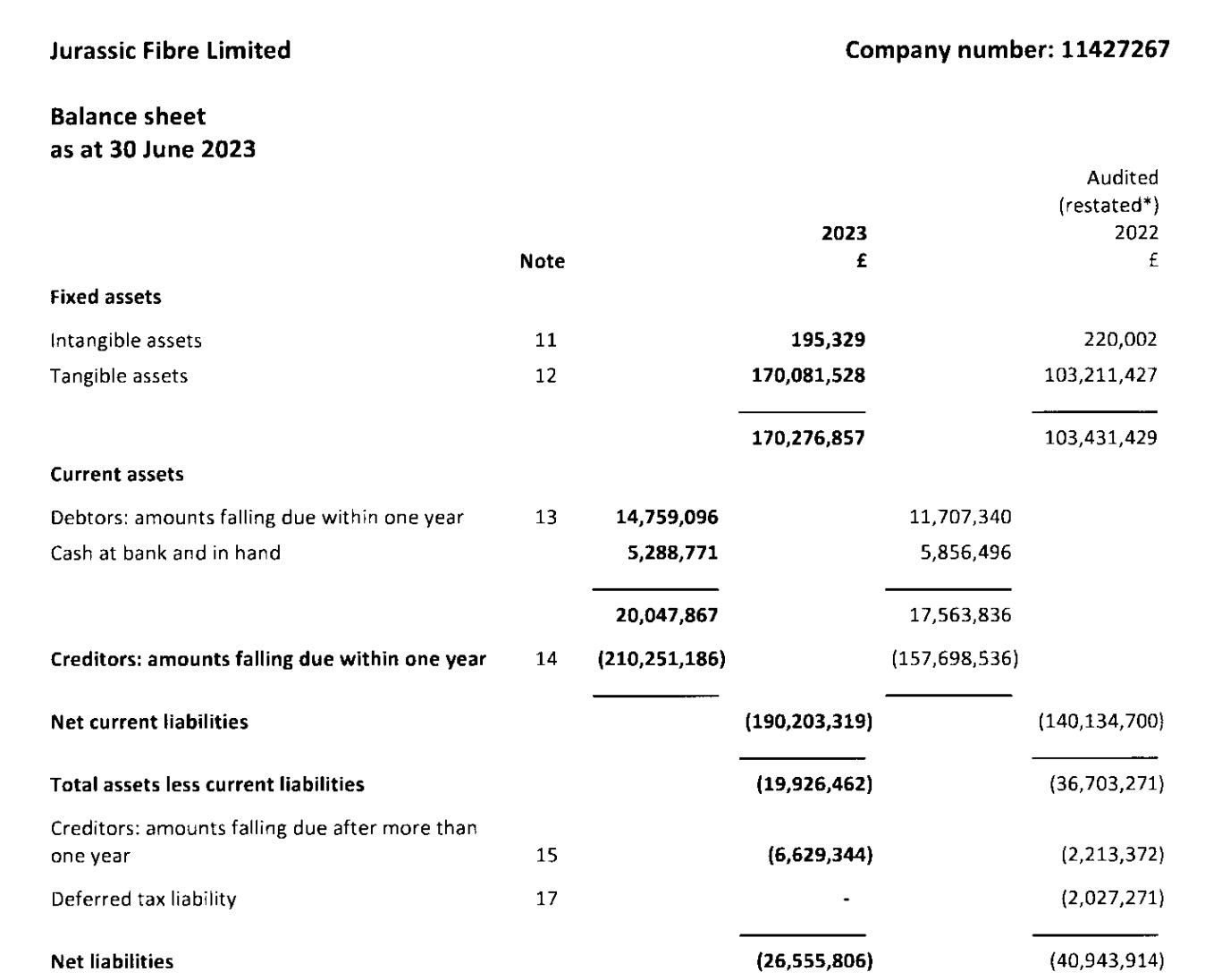

- Example: Jurassic Fibre Limited, a UK-based company which provides full-fibre broadband services, had £5,288,771 of Cash as of 2023.

Debtors

- Definition: Debtors are amounts owed to the company by customers who have purchased goods or services on credit. These receivables are expected to be collected within one year and are critical for maintaining the company’s short-term cash flow. They contribute to the company’s liquidity.

- Alternate names: Accounts receivable, trade debtors, short-term debtors, debtors amounts falling due within one year.

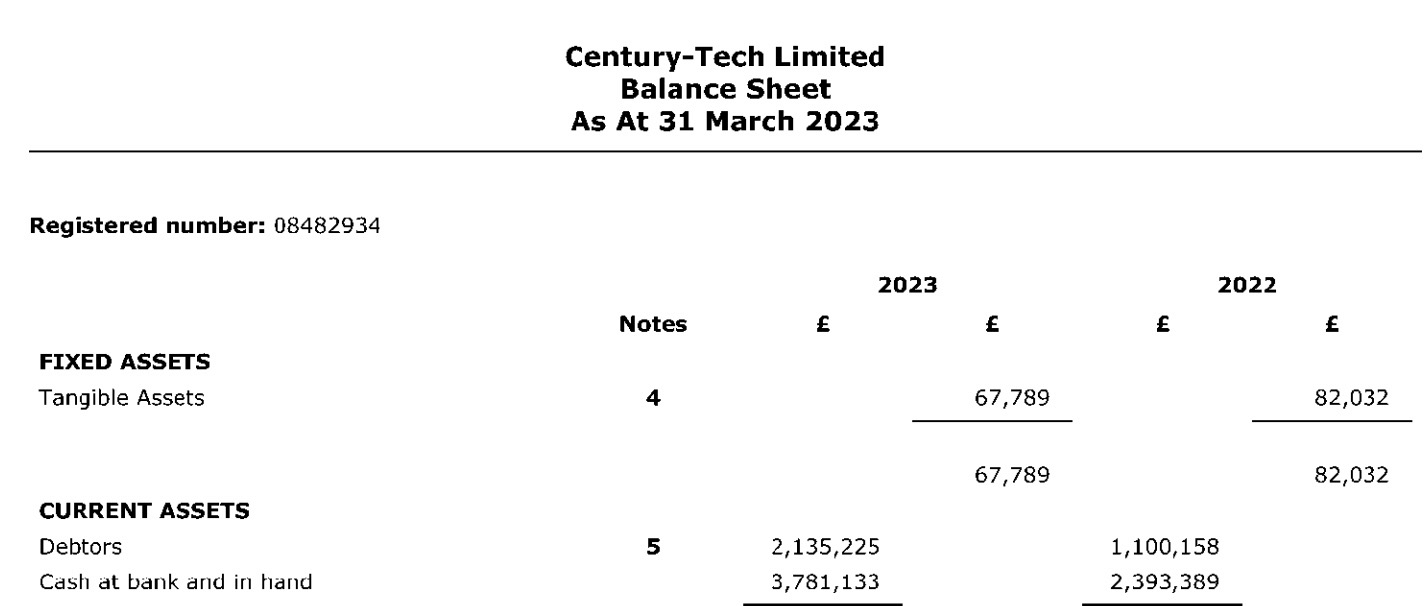

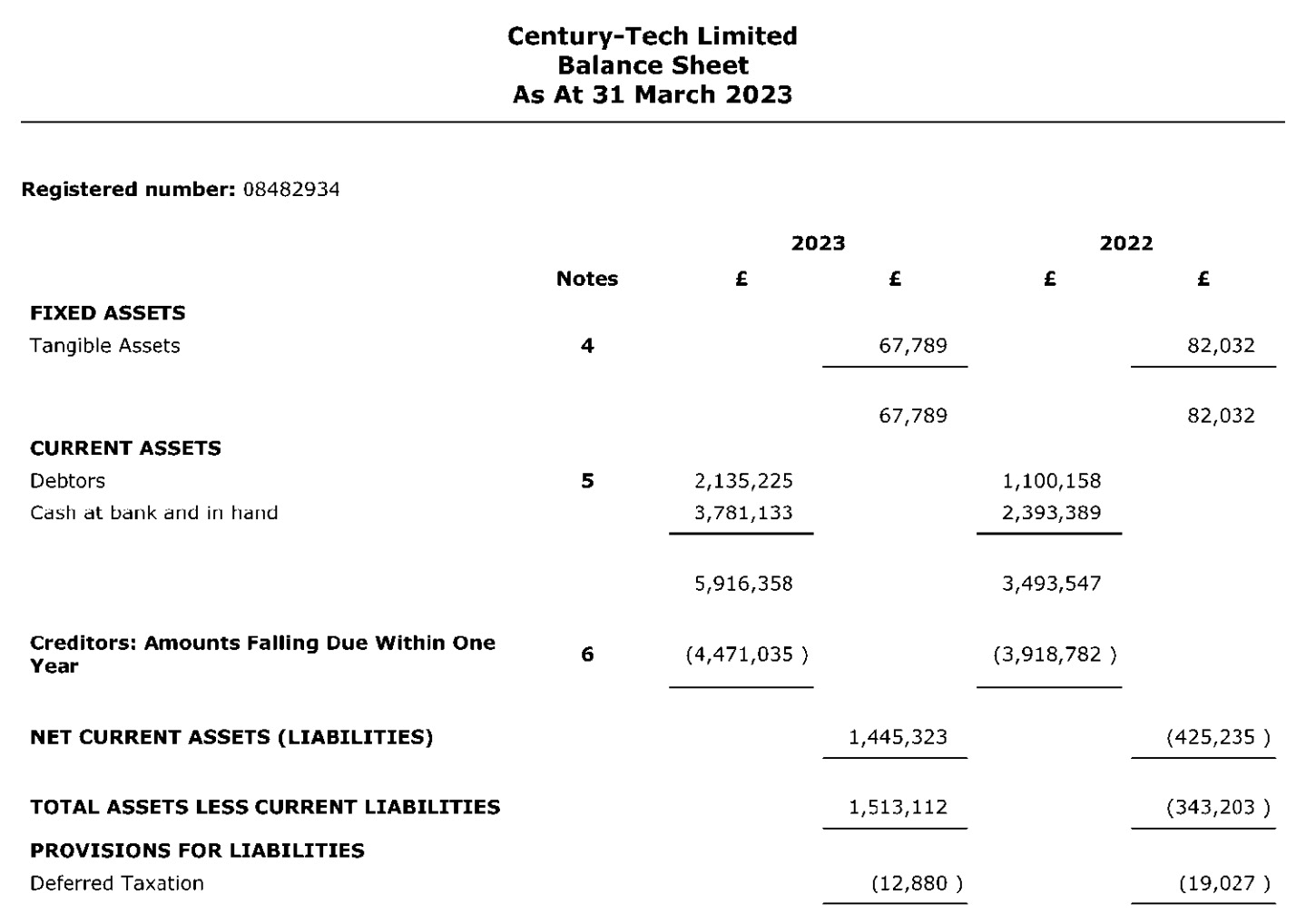

- Example: Century-Tech Limited is a UK-based educational technology company that provides AI-driven learning platforms. As of 31 March 2023, they reported £2,135,225 in debtors, which, according to the Notes to the Financial Statements correspond to trade debtors (amounts owed by customers for service), prepayments and accrued income and other debtors. These receivables support the company's short-term liquidity and operations in the ed-tech sector.

Inventory

- Definition: Inventory, also known as stock, refers to goods that the company holds for sale or raw materials used in production. For retailers or manufacturers, inventory is a significant asset, as it represents the products that will eventually be sold to generate revenue. Inventory is classified as a current asset because it is expected to be sold and converted into cash within one year. Inventory should be monitored closely to ensure that slow moving older stock is valued appropriately so that liquidity does not become an issue.

- Alternate names: Stock, Goods for Sale, Inventory Holdings

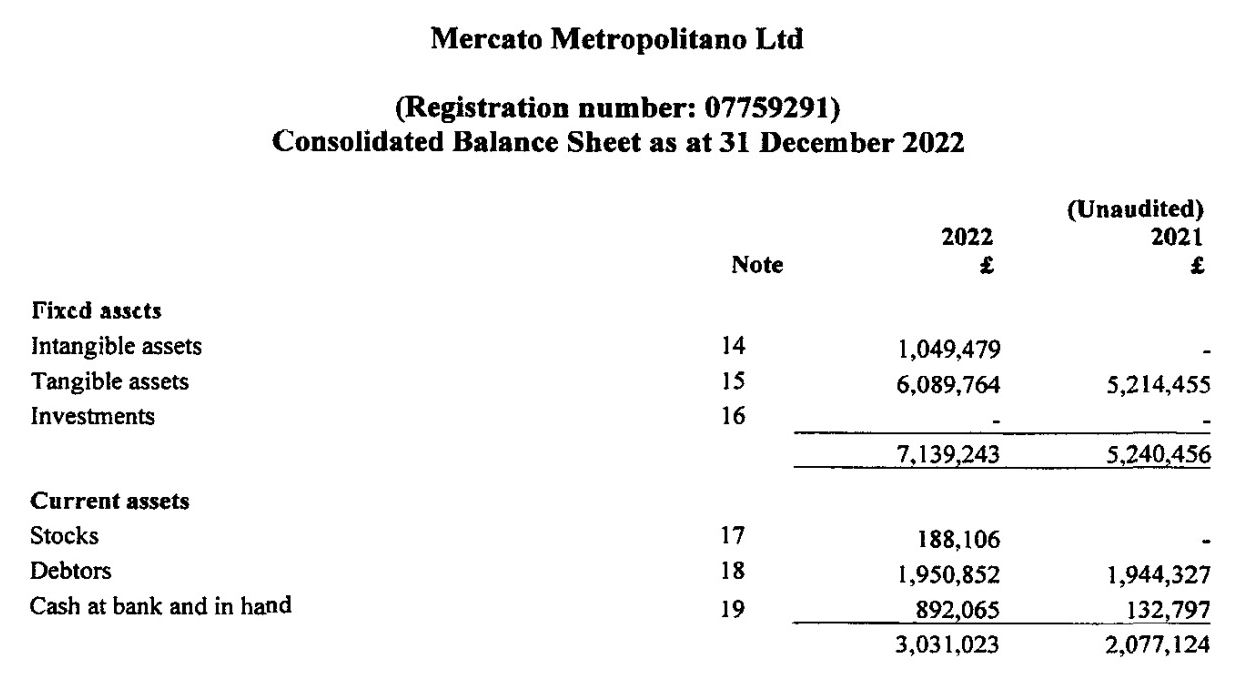

- Example: Mercato Metropolitano Ltd reported £188,106 in finished goods and goods for resale as of 2022. This inventory represents products the company holds for sale, which is vital for their operations as a provider of community market services. The stock includes items like retail food, which are expected to be sold to generate revenue. Inventory is a crucial current asset for the company, reflecting goods that are likely to be sold within the year to maintain liquidity.

Why current assets matter

Current assets are crucial for the financial health of a business. They are directly linked to the company’s ability to manage its short-term obligations, such as paying suppliers, salaries, and other operational costs. Unlike non-current assets, which are held for long-term use, current assets are liquid and can be quickly converted into cash.

Efficient management of current assets ensures a company has enough liquidity to cover immediate expenses and avoid cash flow issues. It’s important to note that while current assets provide liquidity, non-current assets (like buildings or machinery) contribute to the company’s long-term operational strength.

Current assets are typically not held long enough for their value to diminish over time, so they are not subject to depreciation (which applies to tangible fixed assets) or amortisation (which applies to intangible assets). Instead, current assets are generally consumed or converted into cash within the operating cycle of the business. However, certain current assets, particularly inventory, may be subject to impairment if they become obsolete, damaged, or aged beyond their useful life. In such cases, companies may need to write down the value of these assets to reflect their reduced market value or utility, ensuring that current assets are not overstated on the balance sheet.

What are non-current assets?

Definition of non-current assets

Non-Current Assets represent a company's long-term investments that are expected to be held and used for more than one year. These assets are critical to the business's long-term operations and provide future economic benefits. Non-current assets include tangible and intangible assets, as well as long-term financial assets.

Total Non-Current Assets = Tangible Fixed Assets + Intangible Fixed Assets + Long-Term Receivables + Investments + Deferred Tax Assets

- Formula: Total Non-Current Assets = Tangible Fixed Assets + Intangible Fixed Assets + Long-Term Receivables + Investments + Deferred Tax Assets

- Alternate name: long-term assets

Components of non-current assets

Tangible Fixed Assets (Property, Plant, and Equipment – PP&E)

- Definition: Physical, long-term assets such as buildings, machinery, and equipment used in business operations. These assets are depreciated over time to reflect their usage.

- Alternate names: Fixed assets, Capital assets, Tangible assets.

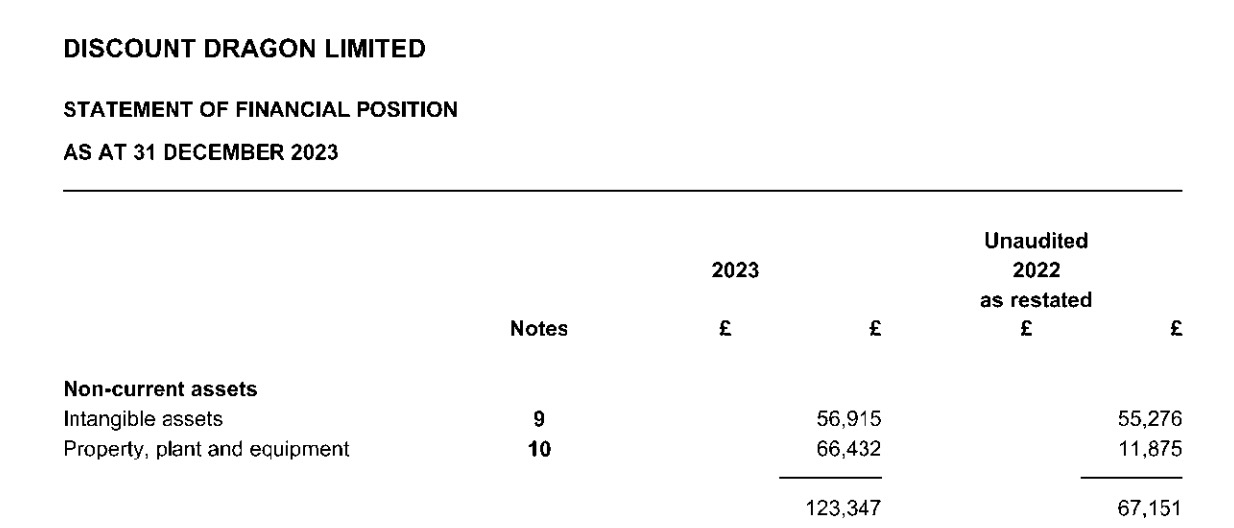

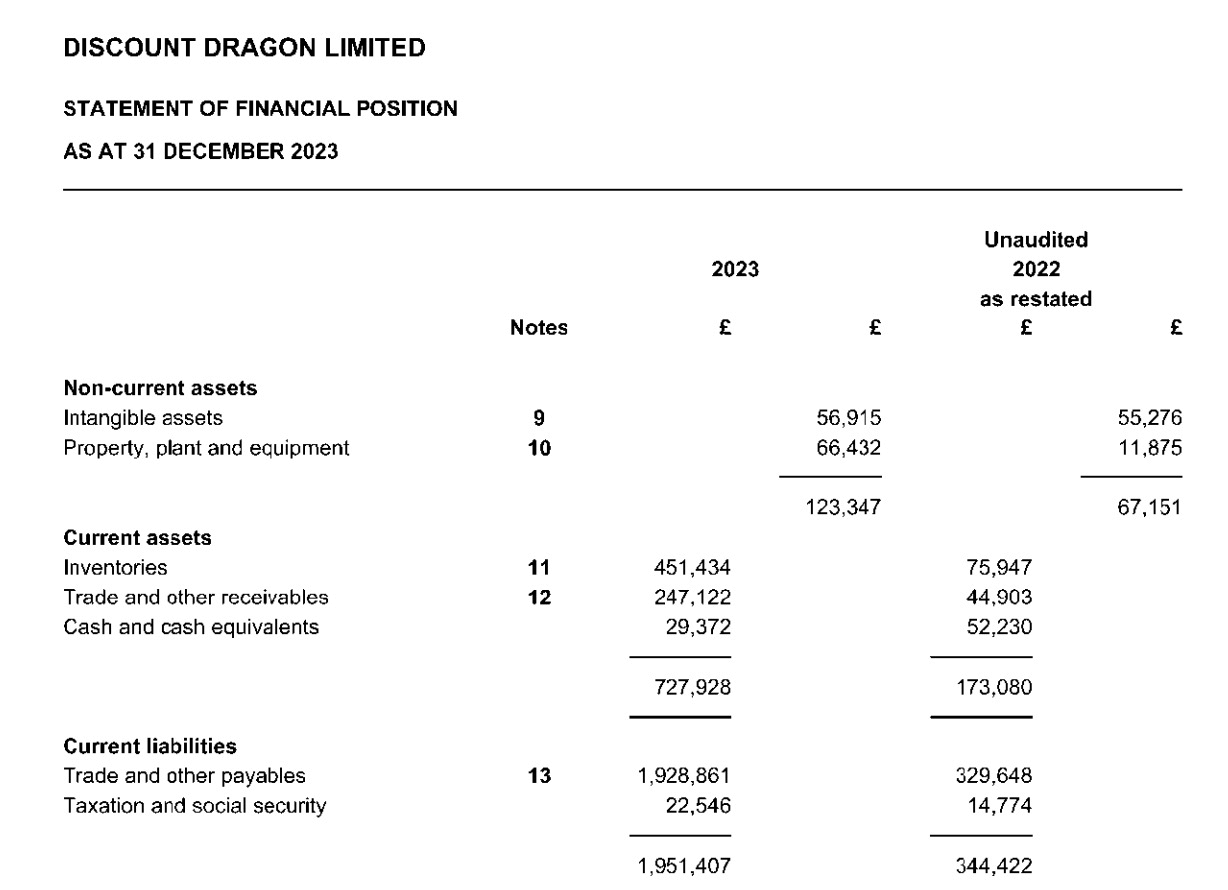

- Example: Discount Dragon Limited, a company specialising in e-commerce, reports £66,432 in tangible fixed assets on its 2023 balance sheet. These include plant and equipment, motor vehicles, and fixtures and fittings.

- The company invested in new property, plant, and equipment during the year, which represents a critical investment in their long-term operational capacity.

Intangible Fixed Assets

- Definition: Non-physical assets that provide long-term value, such as intellectual property (e.g., patents, trademarks) and goodwill. These assets are typically amortised over time. We talk about amortisation below and how it affects the value of fixed assets.

- Alternate names: Intellectual property, Non-physical assets, Intangible assets.

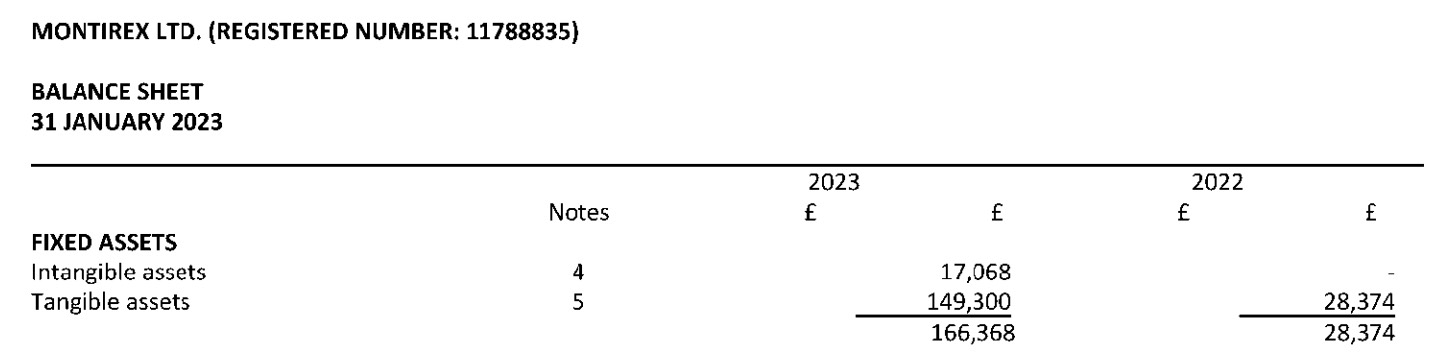

- Example: In Montirex Ltd’s 2023 balance sheet, the company, which specialises in producing high-quality activewear, reports £17,068 in intangible assets, comprising patents, licences, and computer software. The Notes to the financial statements explain that these assets include both patents and software amortised over a five-year period.

Long-Term Receivables

- Definition: Amounts owed to the company that are not expected to be collected within the next year. These receivables arise from extended credit terms or loans granted to customers or other entities.

- Alternate names: Debtors – amounts falling due after more than one year, Long-term debtors.

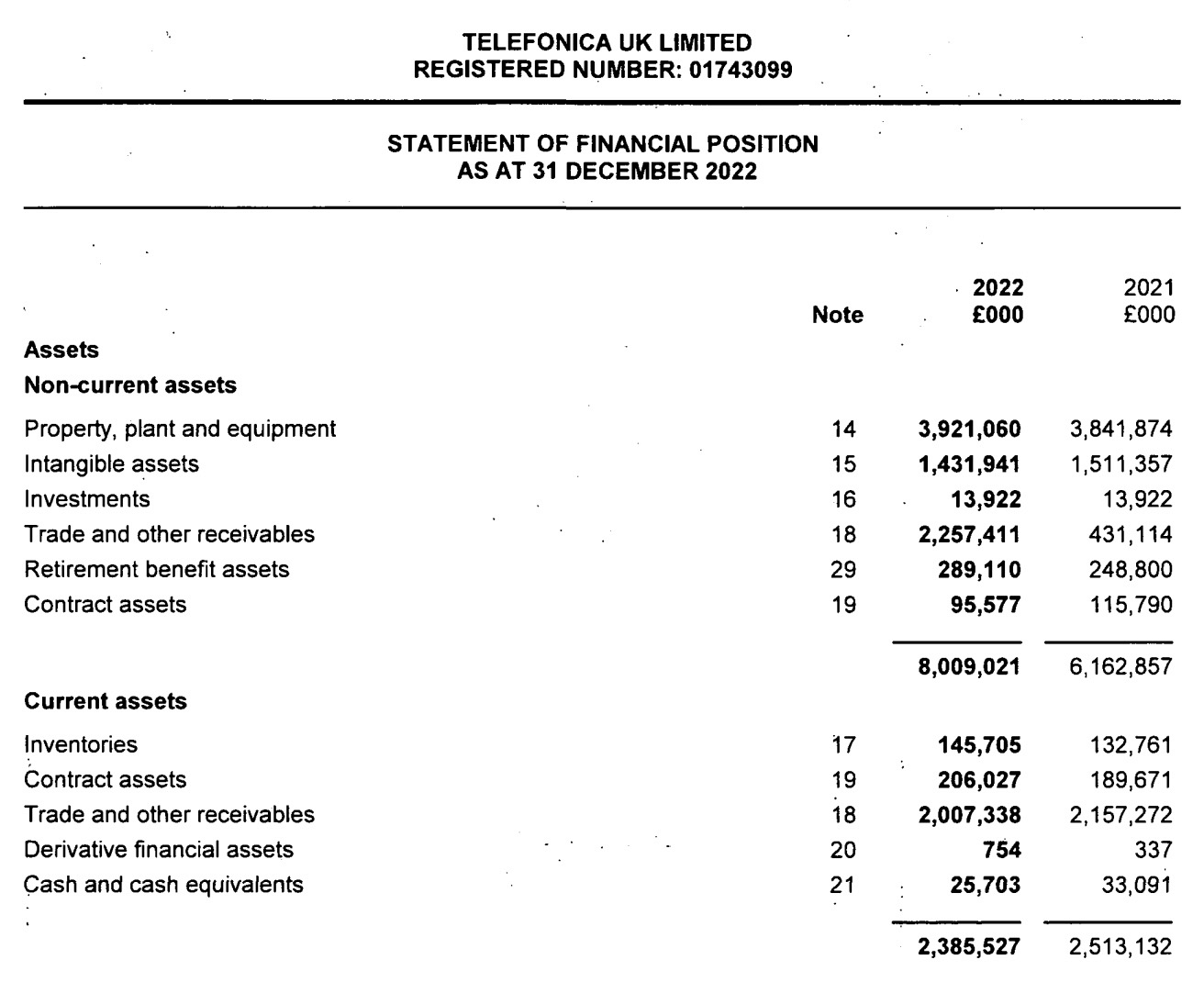

- Example: In Telefónica UK’s 2022 balance sheet, the company reported non-current trade and other receivables of £2,257,411, which, according to the Financial Statements Notes, included £92,560 in trade receivables and £2,058,283 owed by group undertakings. These long-term receivables represent amounts that Telefónica UK is not expecting to collect within the next 12 months, indicating extended credit terms with other group companies or long-term contracts.

Investments (Long-Term Financial Investments)

- Definition: Long-term financial assets, such as equity in other companies, bonds, or long-term loans, that are expected to generate returns over time.

- Alternate names: Non-current investments, Fixed investments.

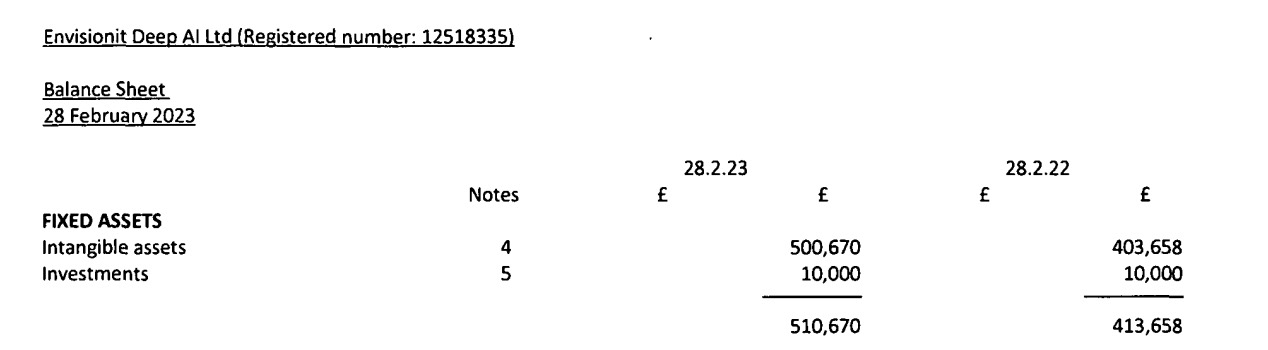

- Example: Envisionit Deep AI Ltd, a company specialising in artificial intelligence solutions for the healthcare sector, reports £10,000 in investments in its 2023 balance sheet. These are classified as shares in group undertakings, indicating that Envisionit has invested in its subsidiary undertakings. This is classified as a long-term investment since it is expected to generate returns in the future.

Deferred Tax Assets

- Definition: Tax benefits that arise due to temporary differences between accounting standards and tax rules. These assets represent future tax deductions that the company will be able to claim. Deferred tax assets typically emerge when a company has recognized a loss for accounting purposes that hasn't yet been recognized for tax purposes, allowing the company to reduce future taxable income.

- Alternate names: Deferred tax, Tax credit assets.

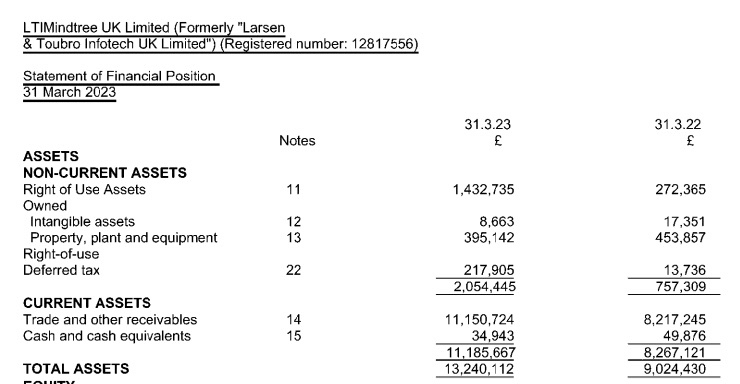

- Example: In the 2023 financial statements for LTIMindtree UK Limited, the subsidiary of an Indian IT company, the company reported a deferred tax asset of £217,905. This deferred tax asset represents potential future tax benefits that the company expects to realise due to timing differences between its accounting and tax treatments. Compared to the previous year, when the deferred tax asset was only £13,736, this increase suggests that the company expects to offset tax from future taxable profits with the accumulated tax losses or timing differences recognized in 2023.

Goodwill

- Definition: Goodwill represents the excess value paid over the fair market value of a company's identifiable assets when acquiring another business. This includes intangible factors such as brand recognition, customer loyalty, and the company's market reputation. Although goodwill is part of intangible assets, it doesn't typically appear as a direct line on the balance sheet because it's a sub-account within intangible assets. Goodwill is not amortised but can be impaired if its value declines due to changes in the business or external factors.

- Alternate names: Acquired goodwill, Business goodwill.

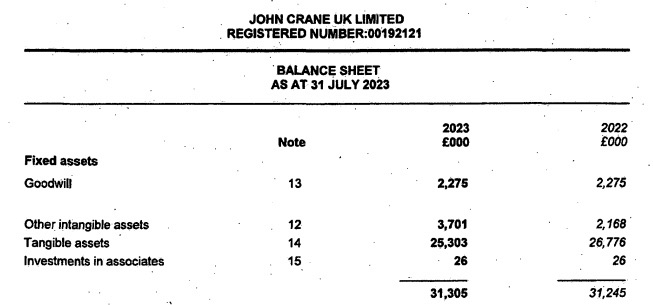

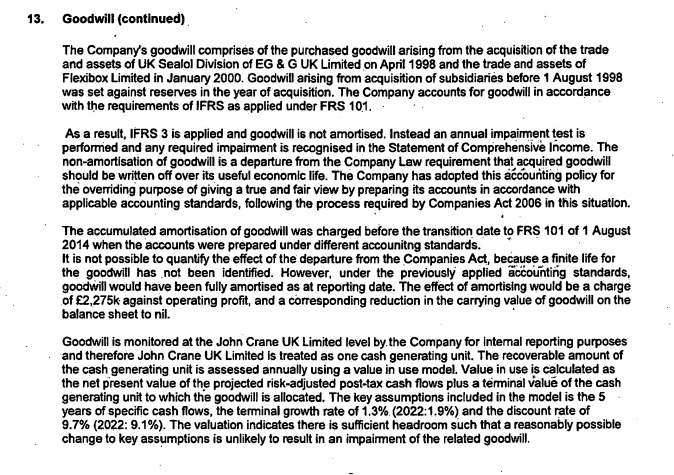

- Example: John Crane UK Limited, a company specialising in mechanical seals and other engineering solutions, reported £2.275 million in goodwill in its 2023 financial statements. As highlighted in the notes to the financial statements, this goodwill originated from the acquisition of various subsidiaries, including E G & G UK Limited and Flexibox Limited, and reflects the additional value John Crane gained from these acquisitions. This value remains on the balance sheet and is monitored annually for impairment.

Notes to the financial statements on Goodwill:

How depreciation, amortisation and impairment apply to non-current assets

Non-current assets are long-term investments that provide value over multiple years. However, their value changes over time, and businesses must account for these changes on their financial statements. Three key methods are used to reflect these changes: depreciation, amortisation, and impairment. These methods help ensure that a company’s balance sheet reflects a realistic and accurate value for its assets.

Below, we’ll explain how each of these methods works, starting with depreciation and amortisation for tangible and intangible assets, followed by impairment, which applies to both.

What is the depreciation?

Depreciation is the systematic reduction in the value of tangible fixed assets, such as machinery, buildings, or vehicles, over their useful lives due to wear and tear or obsolescence. This reduction is accounted for annually in financial statements, with depreciation being recorded as an expense on the income statement, and the net book value of the asset adjusted on the balance sheet.

Methods of depreciation:

- Straight-line depreciation: The cost of the asset is spread evenly across its useful life. Each year, the same amount is deducted from the asset’s value.

- Reducing balance depreciation: A fixed percentage of the asset’s remaining value is deducted each year, which results in higher depreciation charges during the earlier years and lower ones later.

As each year passes, the accumulated depreciation increases, reducing the asset’s net book value (its remaining value on the balance sheet).

Example:

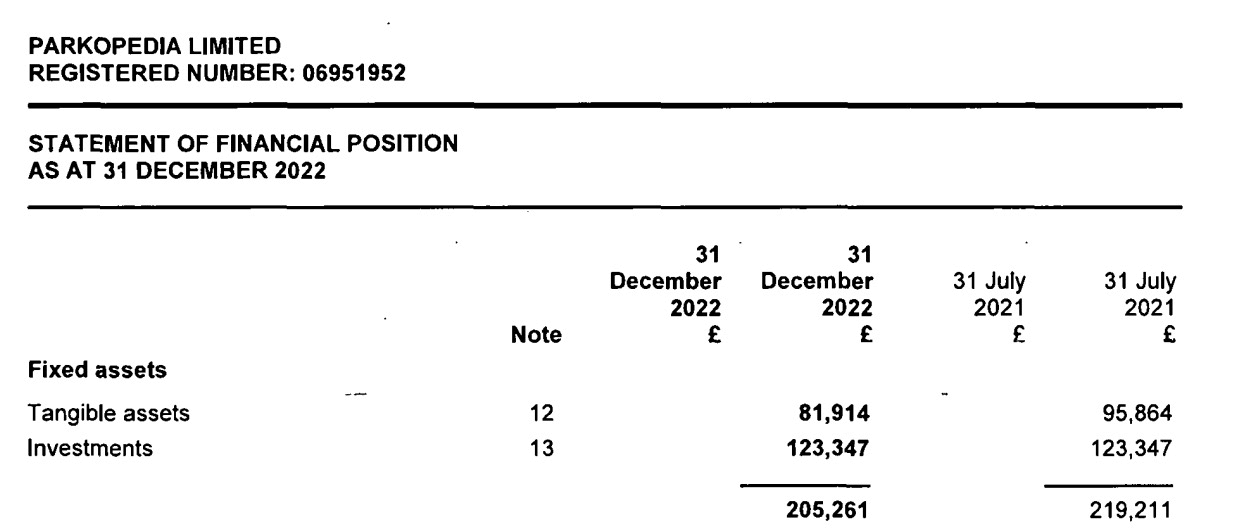

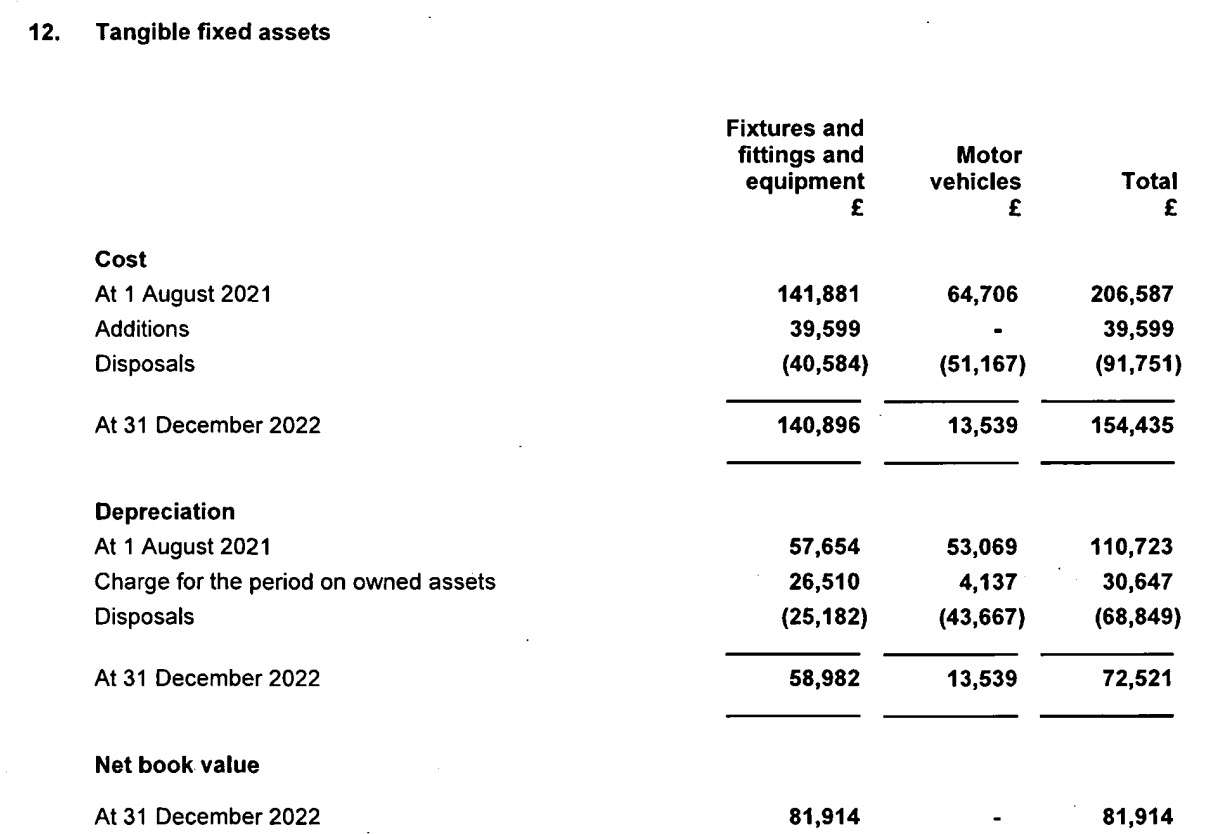

Parkopedia Limited is a UK-registered company that provides digital parking services, offering real-time information on parking spaces through online platforms and apps. In their balance sheet as of 31 December 2022, Parkopedia reports tangible fixed assets valued at £81,914, which are depreciated over time.

Note 12 – shown below – details that motor vehicles and equipment are depreciated using a 20% reducing balance method. This method reflects faster depreciation in the early years of the asset's life, with the accumulated depreciation reducing the asset’s book value over time.

What is amortisation?

Amortisation is similar to depreciation but applies to intangible assets. Intangible assets, such as patents, trademarks, software, and licences, do not physically wear out like machinery or buildings. However, they have a finite useful life, and their value diminishes over time. Amortisation spreads the cost of these assets over their useful life, reflecting their declining value on both the income statement and the balance sheet.

Methods of amortisation:

- Straight-line amortisation: Similar to straight-line depreciation, this method evenly spreads the asset's cost over its expected useful life.

Amortisation only applies to intangible assets with a definite life (e.g., a 5-year software licence). Intangible assets with an indefinite life, like goodwill, are not amortised but are tested annually for impairment.

Example of amortisation calculation:

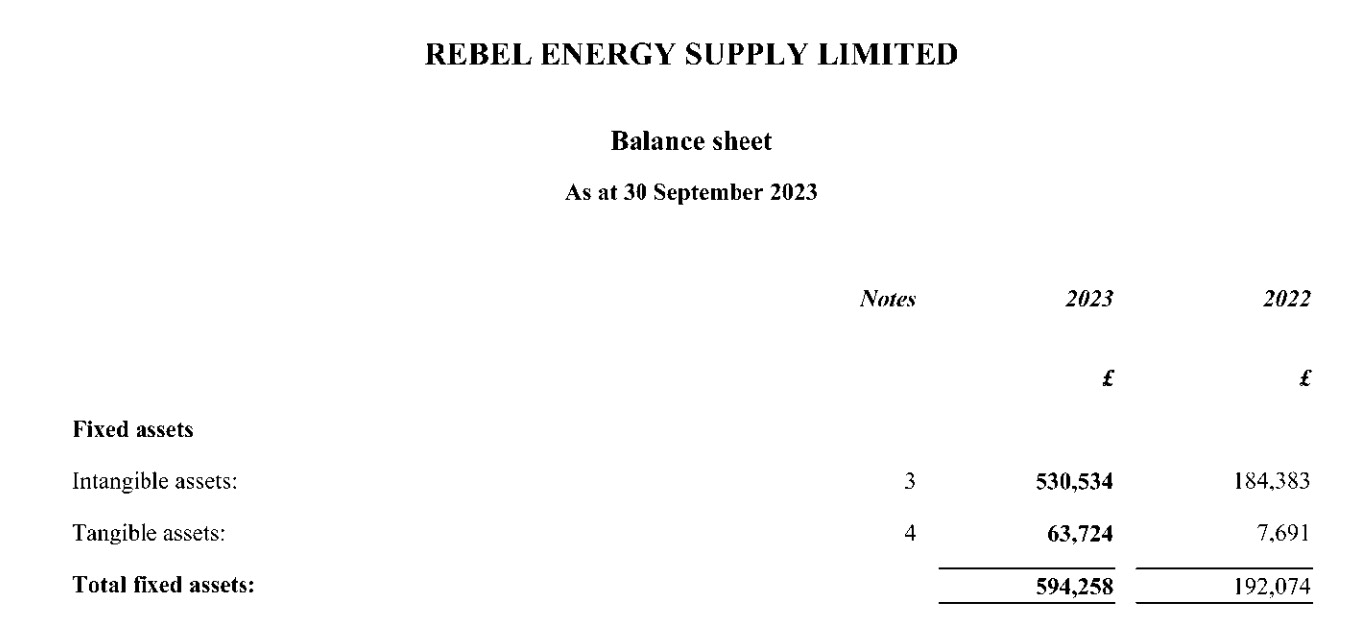

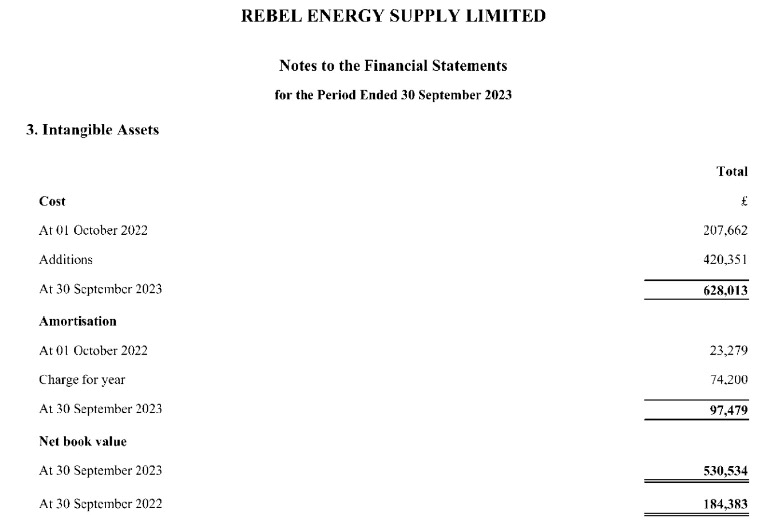

Rebel Energy Supply Limited, which provides energy services, helps explain amortisation in a simple way. In its financials, intangible assets like software are amortised. For instance, in 2023, they had intangible assets worth £530,534, compared to £184,383 in 2022.

According to the Notes to the Financial Statements, Rebel Energy Supply Limited reported an amortisation expense of £74,200 for the year, which helps gradually reduce the value of these assets over time. This information appears in both the balance sheet and the financial notes.

What is impairment?

Impairment occurs when the carrying amount of an asset on the balance sheet exceeds its recoverable value, meaning the asset is worth less than its listed value. This may happen due to damage, obsolescence, changes in market conditions, or a decline in the asset’s usefulness. When an asset is impaired, the company must recognise an impairment loss by writing down the asset's value on the balance sheet.

Impairment applies to both tangible and intangible non-current assets, including goodwill. It ensures that assets are not overstated on the balance sheet and that financial statements provide an accurate reflection of the company’s true financial position.

Example of impairment

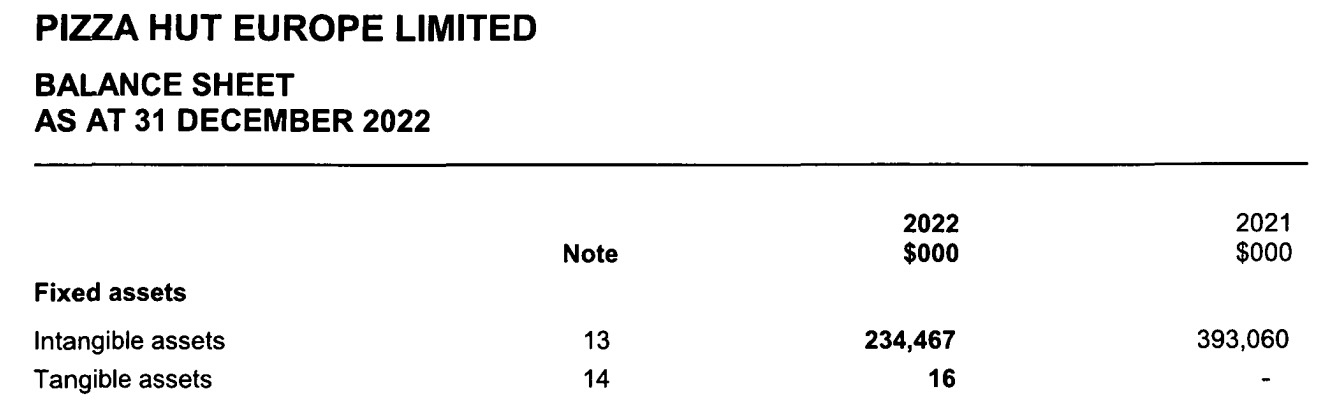

For instance, Pizza Hut Europe Limited, which holds franchise rights for the Pizza Hut brand across Europe, recognised an impairment in 2022 due to slower-than-expected growth and economic challenges. The directors determined that a $135 million impairment charge was necessary for their trademarks, goodwill, and other intangible assets. As a result, the total intangible assets, valued at $393,060,000 in 2021 (with trademarks alone worth $310,860,000), dropped to $234,467,000 by 2022, primarily impacting trademarks and goodwill.

What are liabilities?

Definition of liabilities

Liabilities represent the debts and financial obligations that a company owes to others. These can be short-term obligations, due within a year, or long-term debts, payable after more than one year. Liabilities are an important part of a company’s balance sheet because they show what the company needs to pay in the future.

Total Liabilities = Current Liabilities + Non-Current Liabilities

- Formula: Total Liabilities = Current Liabilities + Non-Current Liabilities

- Alternate names: Obligations, debt, payables.

Components of liabilities

Liabilities can be classified into two major categories:

- Current Liabilities: Debts or obligations due within one year, such as accounts payable, short-term loans, and accrued expenses. In short, this is what the company needs to pay in the short term.

- Non-Current Liabilities: Obligations that are due after one year, such as long-term loans, bonds payable, and deferred tax liabilities. In other words, this is what the company needs to pay in the longer-term.

Let’s describe both current liabilities and non-current liabilities.

Current liabilities

Definition of current liabilities

Current Liabilities are the company’s short-term debts that are expected to be settled within one year. These obligations are typically paid off using current assets like cash or receivables. Current liabilities include things like amounts owed to suppliers and employees, short-term loans, and taxes due.

Current Liabilities = Creditors due within one year + Short-term loans + Taxes due

- Formula: Current Liabilities = Creditors due within one year + Short-term loans + Taxes due

- Alternate names: Short-term liabilities, Immediate obligations

Components of current liabilities

Creditors: amounts falling due within one year

- Definition: These are amounts the company owes to its suppliers, employees, or other creditors that must be paid within the next 12 months.

- Alternate names: Short-term creditors, payables.

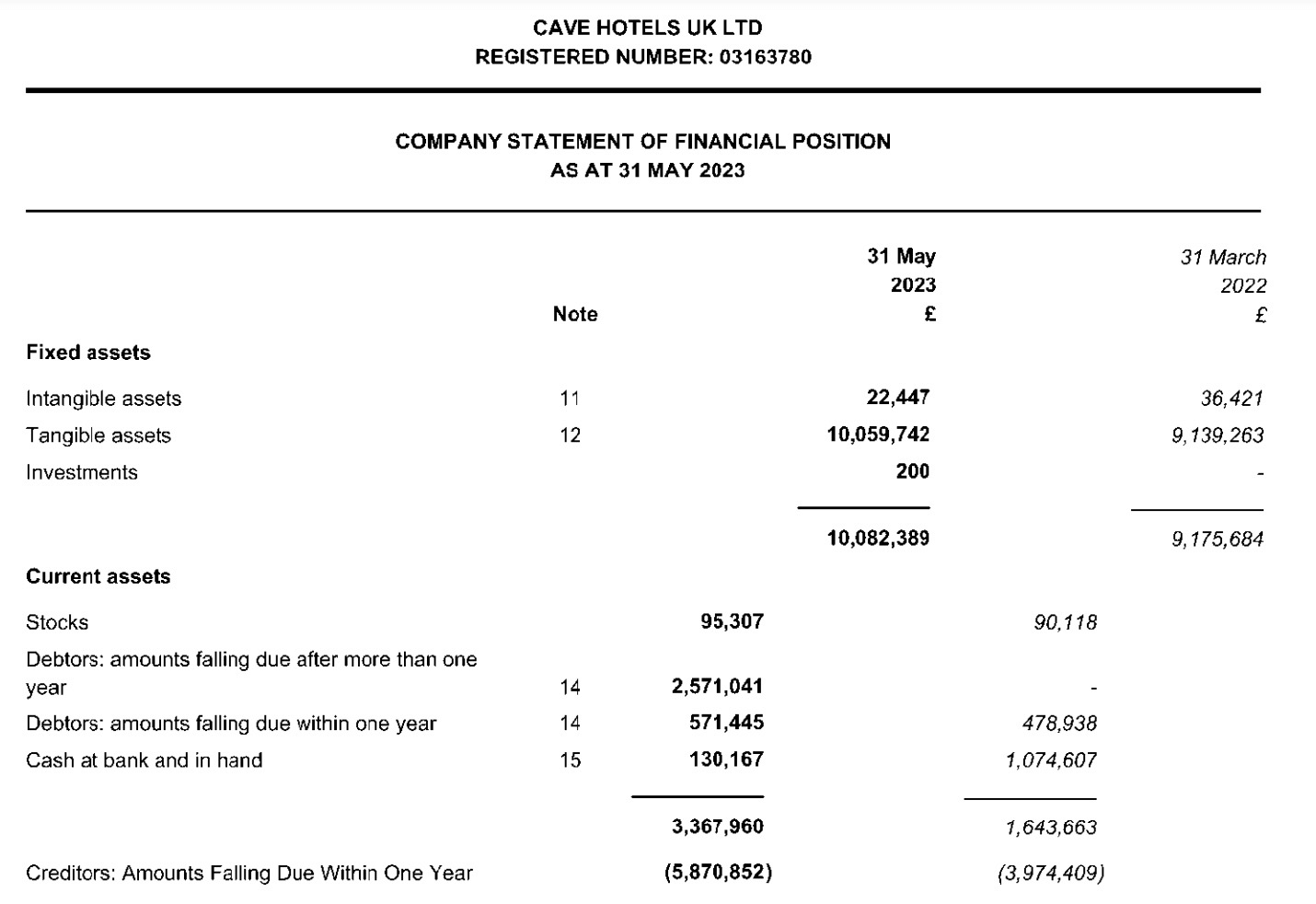

- Example: Cave Hotels UK Ltd, a hospitality company providing luxury accommodation, reported £5,870,852 in creditors: amounts falling due within one year as of 31 May 2023. This liability represents amounts owed to suppliers, employees, or other creditors that must be settled within 12 months. These short-term liabilities are crucial for managing cash flow and ensuring smooth operations, as they include expenses like supplier invoices, staff salaries, and other immediate obligations.

Short-term loans

- Definition: These are loans that the company must repay within a year. They are usually part of financing arrangements to meet immediate cash flow needs.

- Alternate names: Short-term borrowings, temporary loans.

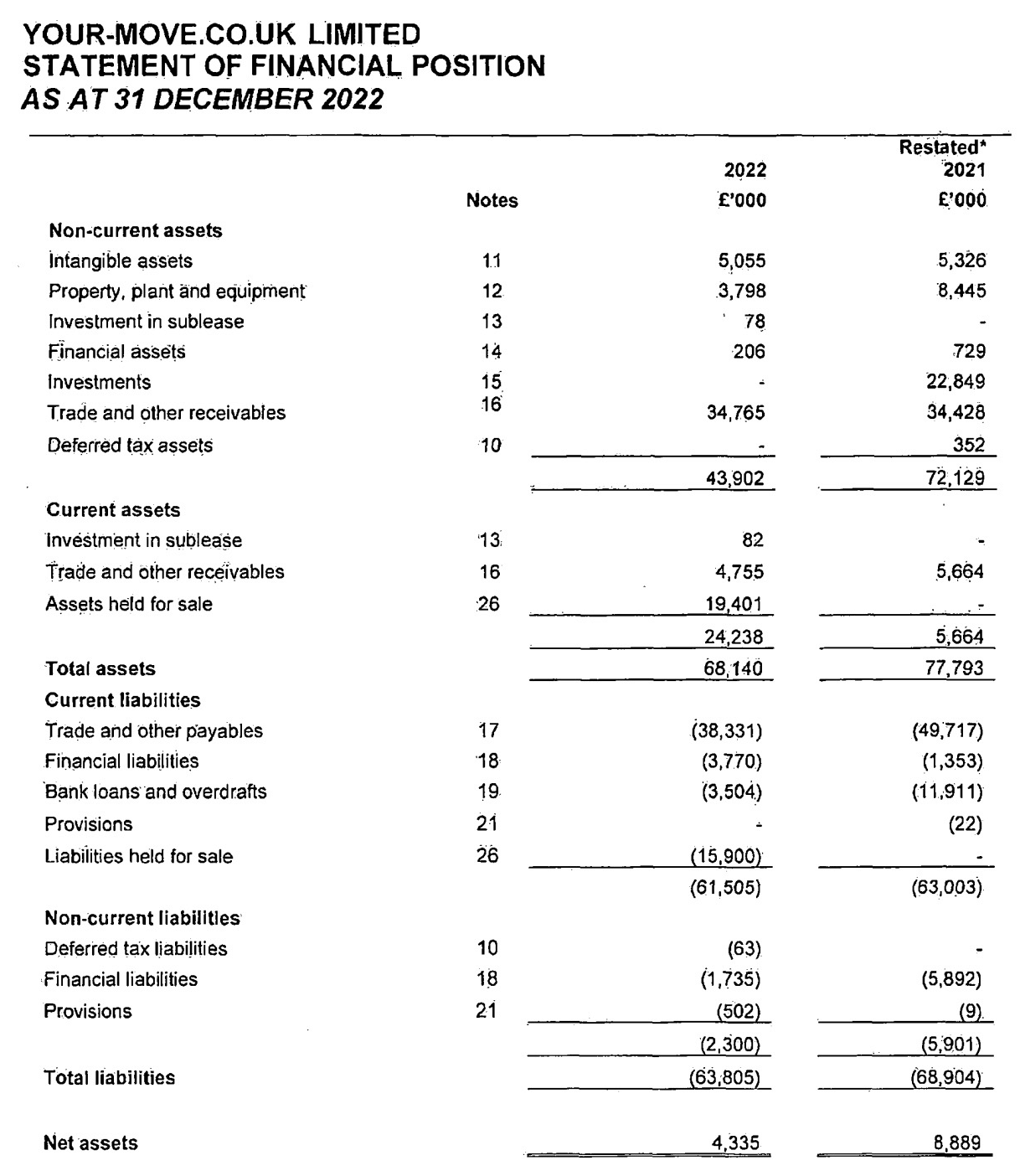

- Example: Your-Move.co.uk Limited is a UK real estate agency offering property services such as sales, lettings, and mortgage advice. In its 2022 filings, the company reported £3,504,000 in bank loans and overdrafts under current liabilities, which must be repaid within 12 months.

Taxes payable

- Definition: This includes taxes owed to the government, such as corporate tax, VAT, or other levies that must be paid within the year.

- Alternate names: Tax liabilities, taxes due.

- Example: In Discount Dragon Limited’s 2023 financial statement, the company reports £22,546 under Taxation and Social Security in its current liabilities. This figure represents the company's tax obligations and social security contributions that are due within the year.

Non-Current Liabilities (Long-Term Liabilities)

Definition of non-current liabilities

Non-Current Liabilities are long-term financial obligations that are not expected to be paid within the next 12 months. These liabilities often include long-term loans, deferred tax liabilities, and provisions for future expenses. They represent debts that the company will pay off over a longer period, typically funded by long-term assets or profits generated in the future.

Non-Current Liabilities = Creditors due after more than one year + Deferred tax liabilities + Provisions for liabilities

- Formula: Non-Current Liabilities = Creditors due after more than one year + Deferred tax liabilities + Provisions for liabilities

- Alternate Names: long-term liabilities, future obligations

Key components of non-current liabilities

Creditors: Amounts Falling Due After More Than One Year

- Definition: These are amounts owed to creditors that the company will not need to pay within the next 12 months. They can include long-term supplier agreements or loans with extended payment terms.

- Alternate names: Long-term creditors, deferred payables.

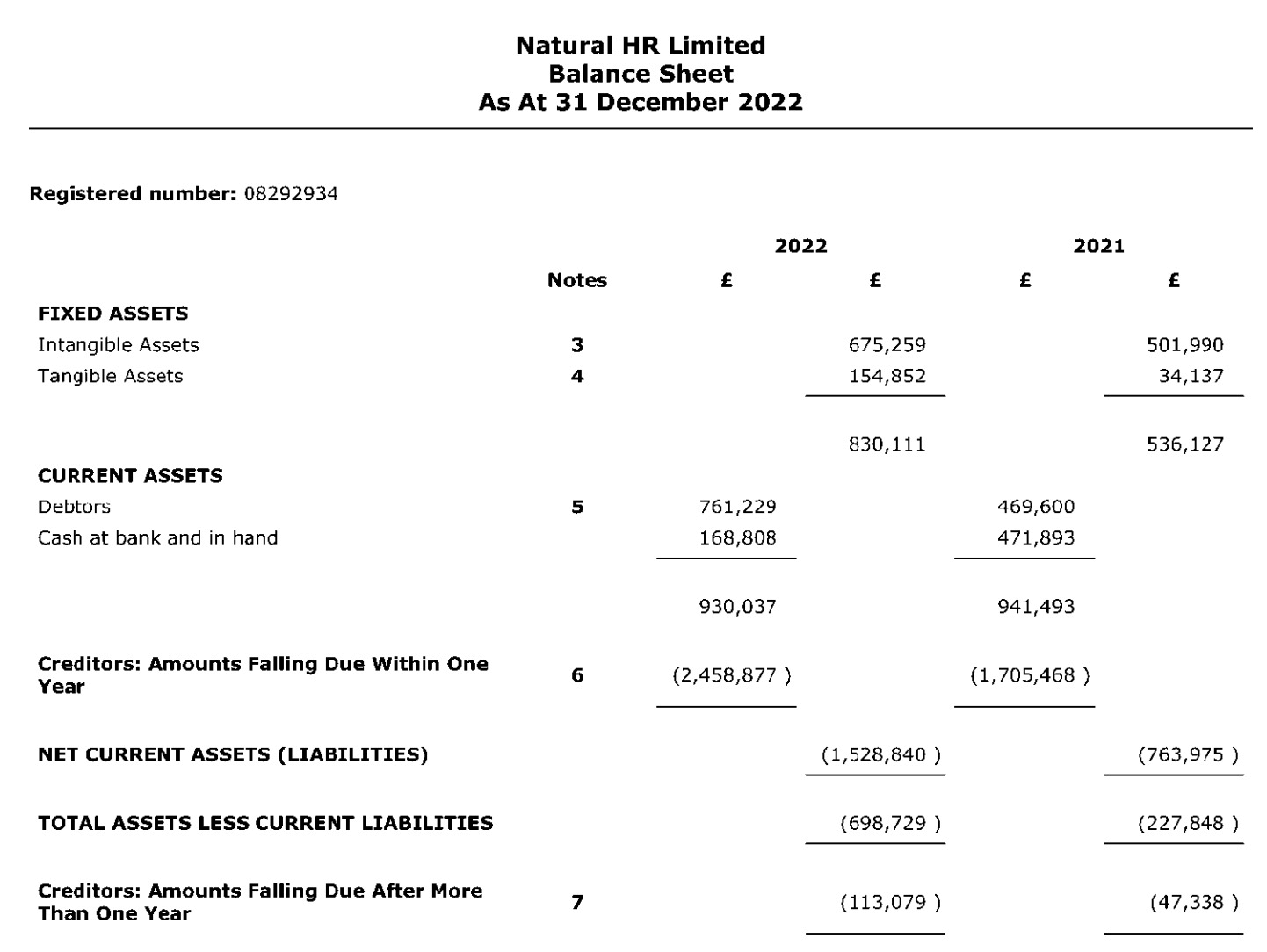

- Example: Natural HR Limited is a company that provides cloud-based human resources (HR) and payroll software solutions to businesses, helping them manage their HR processes more efficiently. In Natural HR Limited's 2022 balance sheet, the company reports £113,079 in bank loans under creditors: amounts falling due after more than one year. These non-current liabilities represent long-term debt obligations that Natural HR will not need to settle within the next 12 months. Having such liabilities allows the company to spread payments over an extended period, helping to manage cash flow while still supporting business expansion.

Provisions for Liabilities

- Definition: Provisions represent money set aside for future expenses or obligations that the company expects to face but for which the exact amount or timing may not yet be known. Common provisions include legal settlements, pension obligations, or warranties.

- Alternate names: Liability provisions, future liabilities.

- Example: Century-Tech Limited is a company specialising in developing educational technology that uses data analytics and artificial intelligence to improve learning outcomes. In its 2023 balance sheet, the company reports £12,880 under provisions for liabilities (*), specifically for deferred taxation. Provisions like these represent funds set aside to cover future obligations, such as tax liabilities that may arise due to timing differences between accounting and tax regulations. By allocating this provision, Century-Tech ensures it is prepared for future tax obligations, demonstrating prudent financial planning for anticipated liabilities.

Deferred Tax Liabilities

- Definition: These represent taxes that are owed but are deferred to a future period due to differences between accounting practices and tax regulations. Deferred tax liabilities arise when a company has to pay tax on income that it has not yet recognised as taxable profit.

- Alternate names: Deferred taxes, future tax obligations.

- Example: Jurassic Fibre Limited, a company that provides ultrafast full-fibre broadband services across the South West of England, reported a deferred tax liability (*) of £2,027,271 in its June 2022 balance sheet. This deferred tax liability arose due to timing differences between when income is recognized for accounting purposes and when it is recognized for tax purposes. By 30 June 2023, the deferred tax liability had been eliminated, reflecting that Jurassic Fibre resolved these liabilities over the period.

(*) As you can see in the above examples, deferred tax liabilities can appear as either provisions for liabilities or standalone non-current liabilities, depending on how certain the company is about the timing and amount of the obligation. Provisions for liabilities are used when the tax obligation is expected but uncertain in timing or amount. Companies set aside funds for future liabilities that are not yet fully defined. On the other hand, standalone non-current liabilities are used when the deferred tax obligation is clearly defined and more predictable. These are tied to specific timing differences, such as between depreciation for tax and accounting purposes, where the liability is expected to be settled beyond 12 months. The choice between these classifications depends on the company’s financial reporting preferences and the level of certainty regarding future obligations.

What is shareholders’ equity?

Definition of shareholder’s equity

Shareholders’ Equity, also known as owners' equity or net assets, represents the remaining interest in a company's assets after all liabilities have been deducted. It reflects the total capital that shareholders have invested in the company, plus any profits the company has retained over time, after paying out dividends. If the company has accumulated losses, they reduce the shareholders' equity.

Shareholders’ Equity = Total Assets − Total Liabilities

- Formula: Shareholders’ Equity = Total Assets − Total Liabilities

- Alternate names: Net worth, owners' equity, net assets, shareholder’s capital, shareholders’ funds

When net assets are negative, i.e. when the company's liabilities exceed its assets, they are referred to as net liabilities. This indicates that the company owes more than it owns, which can signal financial distress or risk to stakeholders.

Components of shareholder’s equity

Shareholders’ Equity is made up of several key components that together represent the value of the company that belongs to shareholders. Below are the main elements:

Share Capital

- Definition: This is the money invested by shareholders when they buy shares in the company. In UK financial statements, this is often referred to as called up share capital, which includes the nominal value of shares issued by the company.

- Alternate names: Share capital, Called up share capital.

Share Premium Account

- Definition: This account represents the amount shareholders have paid over and above the nominal value of the shares. If shares are issued at a price higher than their face value, the excess is recorded in the share premium account.

- Alternate names: Share premium reserve.

Reserves

- Definition: Reserves refer to the profits retained by the company for future use and specific purposes. They can be subdivided as:

- Retained Earnings (or Profit and Loss Reserves): These represent the accumulated profits the company has kept after paying out dividends. Retained earnings increase over time with reinvested profits and are shown in the equity section of the balance sheet.

- Other Reserves: These include reserves like the capital redemption reserve (created when shares are bought back by the company) or revaluation reserves (when assets are revalued and represent the change in value).

- Alternate Names: Other reserves, Profit and loss account, Profit and loss reserves, Capital redemption reserve.

Accumulated losses

- Definition: These are losses from previous periods that have not been offset by profits. Accumulated losses reduce shareholders' equity, whereas retained earnings increase it. If the company experiences financial losses, they remain on the balance sheet until the company can generate enough profit to cover them.

- Alternate names: Retained losses, Deficits

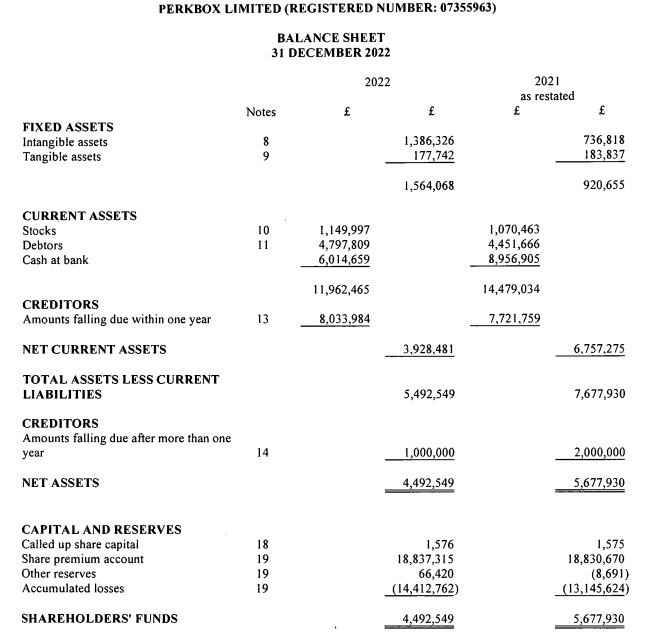

Example of Shareholders' Equity: Perkbox Limited

Perkbox Limited, a UK company that provides an employee experience platform focused on enhancing workplace culture through benefits and rewards, reported £4,492,549 in shareholders’ equity as of 31 December 2022. The shareholders' equity is composed of the following key elements:

- Share Capital: Perkbox lists £1,576 in called-up share capital, reflecting the nominal value of the issued shares.

- Share Premium Account: Perkbox has £18,837,315 in its share premium account, indicating the amount paid by shareholders over the nominal value of the shares.

- Reserves: The company holds £66,420 in other reserves, which are set aside for specific purposes such as asset revaluation or share buybacks. These reserves are not distributable as dividends but represent important protections and adjustments within the company's equity.

- Accumulated Losses: Perkbox reports £14,412,762 in accumulated losses, reflecting financial losses from previous years that have not yet been offset by profits.

Why are retaining earnings important?

Profit plays a direct role in the company's equity because it increases the value retained in the business. Retained earnings represent these profits over time, contributing to the company's growth and stability. If the company consistently generates profit and retains a portion of it, shareholders' equity will grow. However, if the company incurs losses, accumulated losses will reduce equity.

Key balance sheet metrics

In this section, we will cover four important financial metrics that frequently appear in balance sheets filed with Companies House: Net Current Assets, Net Assets Less Current Liabilities, Net Current Liabilities and Net Assets. These metrics are crucial for assessing the financial health and stability of a company.

What are net current assets (working capital)?

Definition of Net Current Assets

Net Current Assets represent the difference between a company’s current assets and current liabilities. This measure is vital for evaluating the company’s ability to cover its short-term financial obligations using its short-term resources.

Net Current Assets = Current Assets − Current Liabilities

- Formula: Net Current Assets = Current Assets − Current Liabilities

- Alternate names: Working capital, Current assets minus current liabilities

Why are Net Current Assets relevant?

Net Current Assets show the difference between a company’s current assets and current liabilities. This figure is crucial for understanding whether a company can cover its short-term debts and continue operating smoothly. Often found in Companies House filings, it gives insight into the company’s short-term financial health and its ability to manage day-to-day operations without running into cash flow problems.

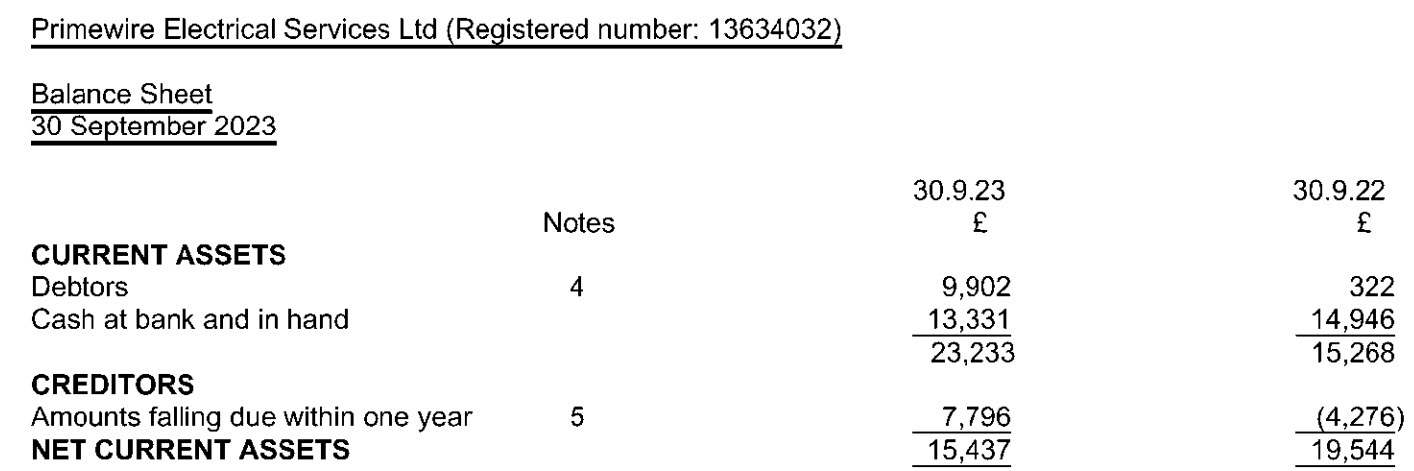

Example of Net Current Assets

In Primewire Electrical Services Ltd's 2023 filings, the company, which specialises in providing electrical services, reports £23,233 in current assets, consisting of £9,902 in debtors and £13,331 in cash at bank. The company's current liabilities amount to £7,796, resulting in net current assets of £15,437. This positive figure indicates that Primewire Electrical Services Ltd can comfortably cover its short-term liabilities with its available resources.

What are “Total Assets Less Current Liabilities”?

Definition of Total Assets Less Current Liabilities

Total Assets Less Current Liabilities is a financial metric that represents the difference between a company's total assets (both current and noncurrent) and its current liabilities. This metric gives a more comprehensive snapshot of a company’s overall financial health, balancing both long-term and short-term obligations.

Total Assets Less Current Liabilities = (Total Assets) − (Current Liabilities)

- Formula: Total Assets Less Current Liabilities = (Total Assets) − (Current Liabilities)

- Alternate names: Net Assets Less Short-Term Liabilities, Total Resources After Short-Term Debts

Why is "Total Assets Less Current Liabilities" important?

This metric provides insight into how much value a company holds after covering its short-term liabilities but before considering long-term obligations. It helps stakeholders understand whether the company has sufficient resources to continue operating in the medium-to-long term without depleting its assets. It’s particularly useful for evaluating the overall financial position, as it considers both long-term and short-term assets relative to immediate obligations.

Example of Total Assets Less Current Liabilities

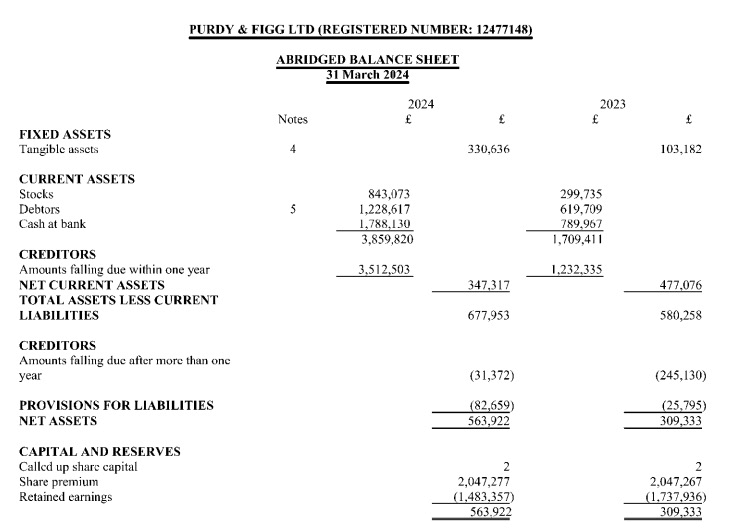

In the 2024 balance sheet for Purdy & Figg Ltd, the company, which specialises in eco-friendly household cleaning products, reports:

- Total assets: £3,859,820 (current assets) + £330,636 (fixed assets) = £4,190,456.

- Current liabilities: £3,512,503.

By subtracting current liabilities from total assets:

- Total Assets Less Current Liabilities = £4,190,456 - £3,512,503 = £677,953.

This figure indicates that after accounting for short-term liabilities, Purdy & Figg Ltd still has £677,953 in assets available to meet its other obligations.

What are net current liabilities?

Definition of net current liabilities

Net Current Liabilities arise when a company’s current liabilities exceed its current assets. This situation implies that the company may face challenges in covering its short-term obligations, potentially leading to liquidity issues.

Net Current Liabilities = Current Liabilities − Current Assets

- Formula: Net Current Liabilities = Current Liabilities − Current Assets

- Alternate names: negative working capital, current liabilities exceeding current assets

Why are net current liabilities important?

Net Current Liabilities are a red flag for a company’s short-term financial health. When current liabilities exceed current assets, it shows that the company may struggle to meet its immediate obligations, which could indicate potential cash flow problems. This metric is essential for creditors and stakeholders to assess the company's liquidity risk.

Example of Net Current Liabilities

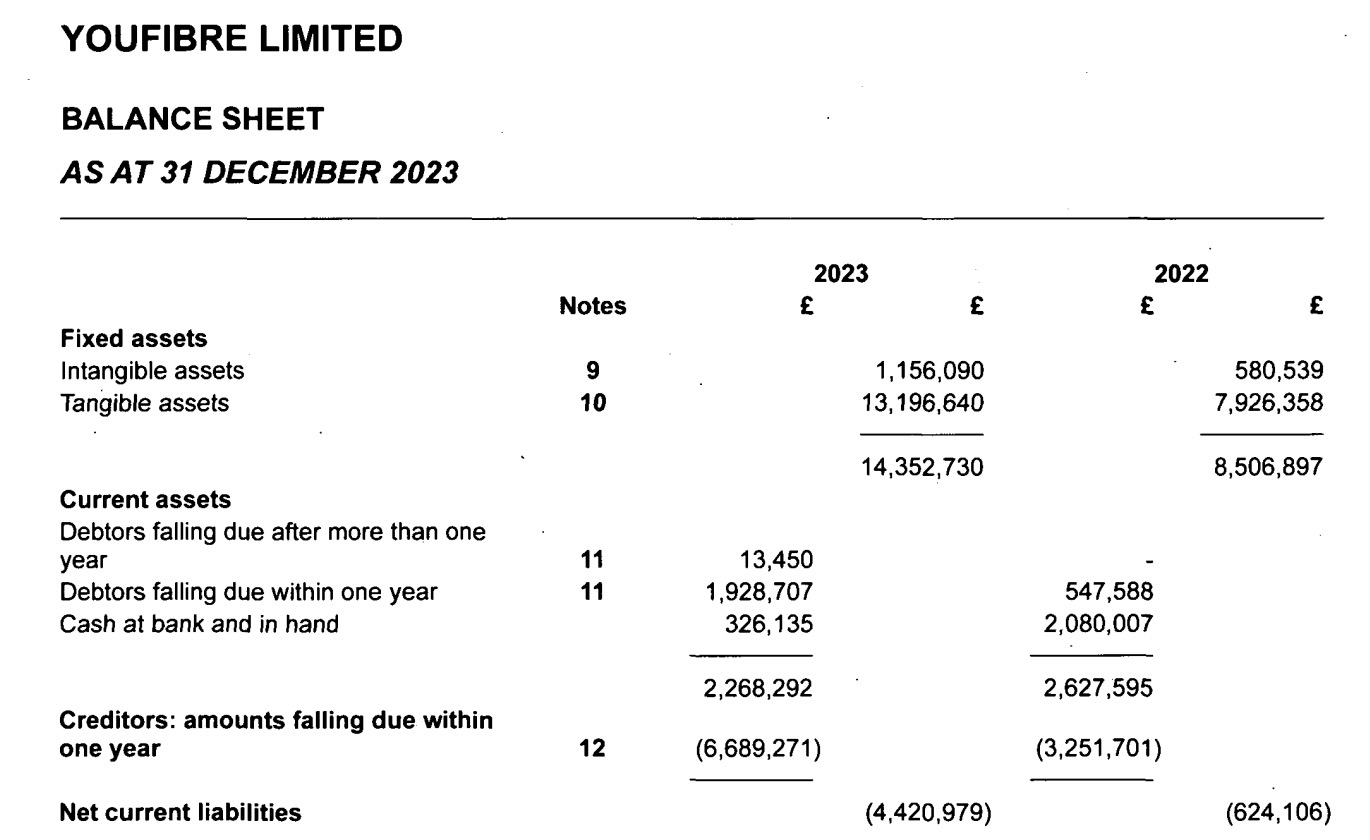

YouFibre Limited, a company that provides ultra-fast fibre broadband services, reported net current liabilities of £4,420,979 as of 31 December 2023. This figure indicates that the company’s current liabilities exceeded its current assets.

What are Net Assets?

Definition of Net Assets

Net Assets represent the total assets of the company minus all liabilities (both current and non-current). This metric is one of the most important for understanding the overall value of the company after accounting for its debts. It is also closely tied to shareholders’ equity, showing the owners' stake in the business.

Net Assets=Total Assets−Total Liabilities

- Formula: Net Assets=Total Assets−Total Liabilities

- Alternate names: Shareholders' equity, total equity, book value

Why are Net Assets important?

Net assets are a key number in financial statements filed with Companies House. They help investors, creditors, and other stakeholders understand how valuable the company is and whether it has enough resources to pay off all its debts if needed. If a company has positive net assets, it means it has more assets than liabilities, which is a sign of financial health.

Example of Net Assets

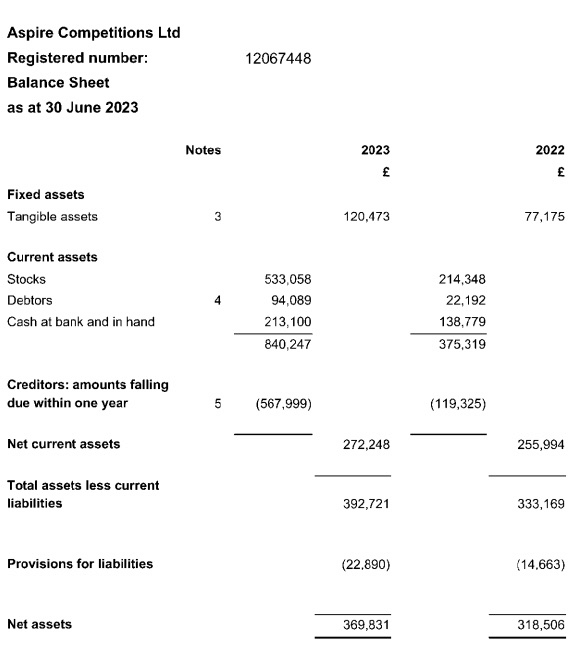

Aspire Competitions Ltd, a company specialising in prize competitions and raffles, reported the following in its 2023 balance sheet:

- Total assets: £840,247 (current assets) + £120,473 (fixed assets) = £960,720.

- Total liabilities: £567,999 (current liabilities) + £22,890 (provisions for liabilities) = £590,889.

Using the formula:

- Net Assets = £960,720 − £590,889 = £369,831.

Key balance sheet ratios

Financial ratios provide a quick way to assess a company's financial health using data from the company accounts. These ratios help investors, creditors, and other stakeholders understand key aspects like liquidity and financial leverage. In this section, we’ll cover two important balance sheet ratios: the Current Ratio and the Debt-to-Equity Ratio.

What is the Current Ratio?

Definition of Current Ratio

The Current Ratio measures a company’s ability to pay off its short-term liabilities with its short-term assets. A higher ratio indicates that the company is better able to cover its short-term obligations. A ratio above 1 is generally considered healthy, as it means the company has more current assets than current liabilities.

Current Ratio = (Current Assets) / (Current Liabilities)

- Formula: Current Ratio = (Current Assets) / (Current Liabilities)

- Alternate names: working capital ratio, liquidity ratio

Why is the Current Ratio important?

The Current Ratio is crucial for assessing a company's liquidity—its ability to meet short-term financial obligations. It helps determine whether the company has enough resources to pay off its debts in the near term, which is essential for maintaining smooth operations. A company with a current ratio above 1 is typically considered more financially stable.

Example of Current Ratio calculation

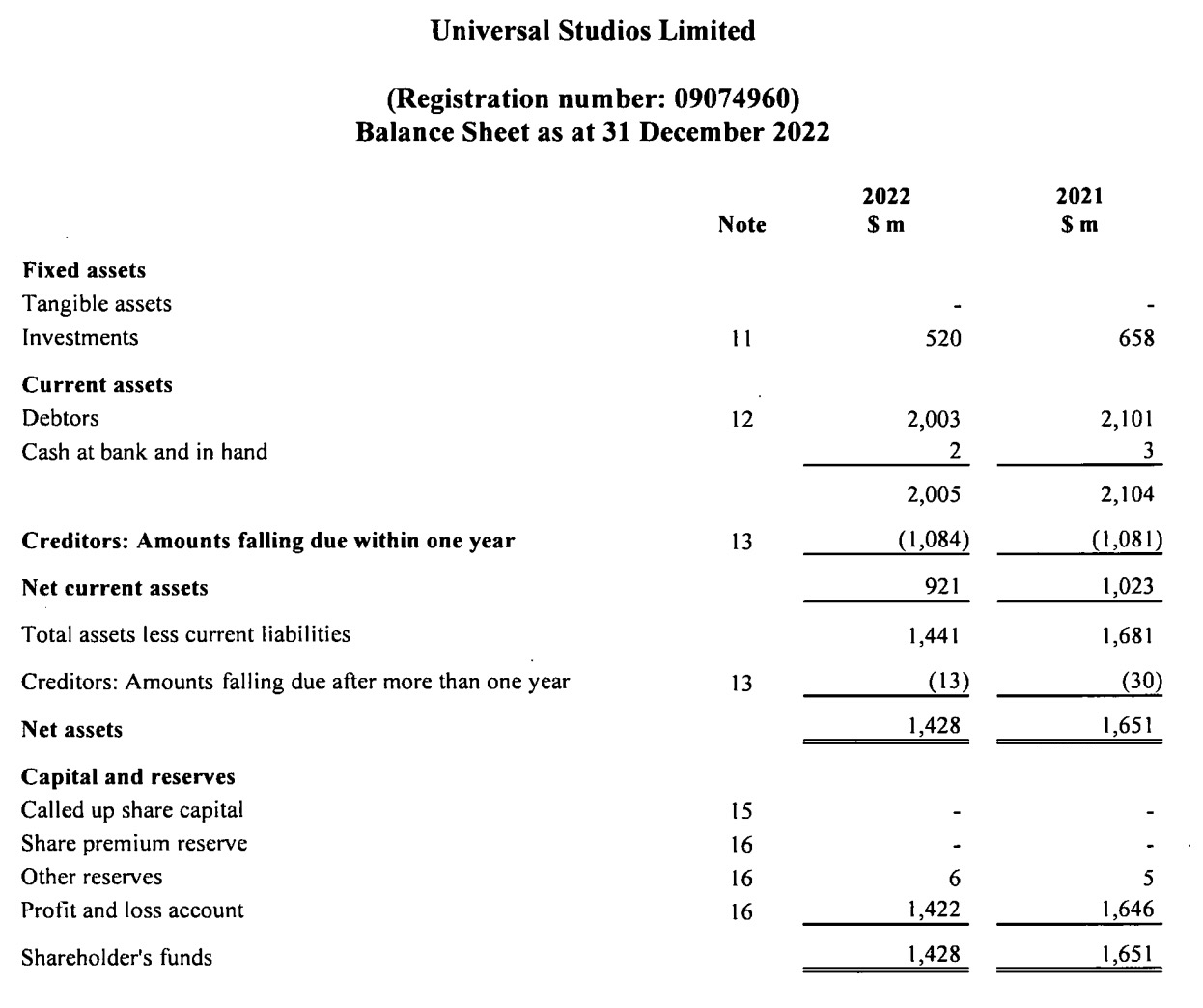

For Universal Studios Limited, a company focused on film production and entertainment services, we can calculate the Current Ratio based on the balance sheet provided.

From the balance sheet:

- Current Assets for 2022: $2,005 million

- Current Liabilities (Creditors: Amounts falling due within one year) for 2022: $1,084 million

Now, applying the formula: Current Ratio = 2,005 / 1,084 ≈ 1.85

This Current Ratio of 1.85 indicates that Universal Studios Limited has 1.85 times more current assets than current liabilities, suggesting the company is in a solid position to meet its short-term obligations. A ratio above 1 generally reflects good financial health.

Debt-to-Equity Ratio

Definition of the debt-to-equity ratio

The Debt-to-Equity Ratio measures how much of a company's financing comes from debt compared to equity. This ratio reflects the level of financial leverage being used by the company. A higher ratio suggests the company relies more on debt for financing its operations, which may indicate higher risk.

Debt-to-Equity Ratio = (Total Liabilities ) / (Shareholder’s Equity)

- Formula: Debt-to-Equity Ratio = (Total Liabilities ) / (Shareholder’s Equity)

- Alternate names: gearing ratio, leverage ratio

Why is the Debt-to-Equity Ratio important?

The Debt-to-Equity Ratio is an important measure of a company’s financial structure and risk. It shows how much of the company’s operations are financed by debt versus equity. A high ratio means the company is heavily reliant on borrowing, which can increase financial risk, especially if the company struggles to meet its debt obligations. A lower ratio indicates more conservative financing, which generally implies lower risk.

Example of Debt-to-Equity Ratio calculation

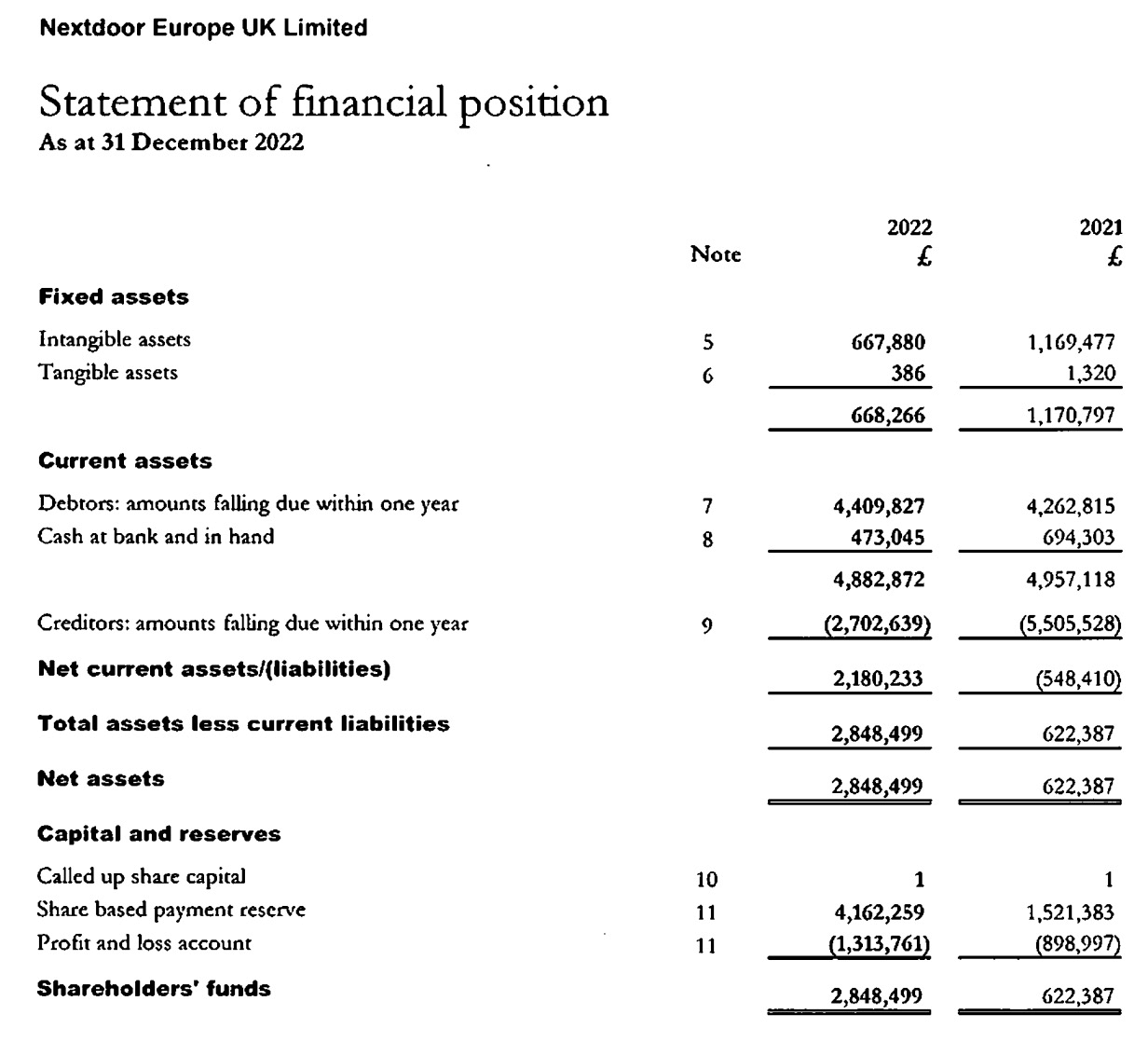

Nextdoor Europe UK Limited, which operates a social media platform for neighbourhoods, has £2,702,639 in liabilities and shareholders' equity of £2,848,499 as of December 2022. Using the formula:

Debt-to-Equity Ratio = £2,702,639 (liabilities) / £2,848,499 (shareholders' equity) = 0.95

This ratio of 0.95 suggests that Nextdoor Europe UK Limited has a balanced financial structure, with slightly less debt than equity, indicating moderate financial risk.

How the balance sheet relates to other financial statements

The balance sheet is interconnected with the profit and loss (P&L) statement and the cash flow statement, providing a full picture of a company’s financial health.

- Profit and Loss Statement (P&L): The P&L shows a company’s financial performance over a specific period, detailing its revenues, expenses, and resulting profit or loss. The net profit or loss from the P&L directly affects the equity section of the balance sheet, specifically retained earnings. A profit increases equity, while a loss decreases it.

- Cash Flow Statement: This statement tracks the actual inflows and outflows of cash, showing how well a company manages its cash resources. It links to the balance sheet through the cash and cash equivalents line. Cash generated from operating, investing, or financing activities directly impacts the company's cash position on the balance sheet.

Together, these financial statements provide a comprehensive view of a company’s operations, showing not only its current financial position (balance sheet) but also how it generates profit (P&L) and manages its cash (cash flow statement).