Net liabilities are more than just a number. They’re a clue into a company’s overall financial health, especially here in the UK.

This article will demystify net liabilities, explaining why they matter and how they connect to debt management and equity in a company’s finances.

So, let’s dive in, no calculators required!

What are net liabilities?

Net liabilities indicate how much a company's total liabilities surpass its total assets, reflecting the gap between what it owes and what it owns. When a company has net liabilities, it means it wouldn’t have enough assets to fully settle its debts if they were due immediately.

Here’s a straightforward formula:

Net Liabilities = Total Liabilities − Total Assets

A positive net liability means liabilities outweigh assets, which could signal financial risk. Conversely, a negative net liability (where assets exceed liabilities) points to a healthier financial position.

Net liabilities serve as a key indicator of a company’s financial health, showing whether it’s well-balanced, overburdened, or on solid footing.

Not all liabilities are created equal, and understanding the different types of obligations that contribute to net liabilities can further illuminate a company’s financial position.

Types of liabilities in the net liabilities calculation

To fully grasp net liabilities, it’s essential to look at its key components: assets, liabilities, and contingent liabilities. By breaking down these elements, we gain a clearer picture of what makes up a company’s financial obligations and resources.

1. Assets

Assets are resources owned or controlled by a company that are expected to generate future economic benefits. They are generally split into two main categories:

- Current Assets: These include cash, debtors (amounts owed by customers, also known as accounts receivable) and inventory—things that can be converted into cash within a year.

- Non-current Assets: These are longer-term assets such as property, plant equipment also referred to as (‘Fixed Assets’), or intangible assets like patents and goodwill.

2. Liabilities

Liabilities represent the financial obligations a company owes to others. They are divided into short-term and long-term liabilities, each impacting the company’s cash flow and financial stability:

- Short-Term - Current Liabilities: These are obligations due within a year, such as loans, taxes, and trade payables (invoices owed to suppliers). Creditors – which shouldn’t be confused with debtors – fall under this category, representing entities or individuals the company owes money to. Managing these is essential for day-to-day operations, as missed payments can lead to immediate cash flow issues.

- Long-Term - Non-current Liabilities: Debts due beyond a year, such as mortgages, bonds, and pension obligations. While they can help fund growth and expansion, they must be managed carefully to prevent long-term financial strain.

3. Contingent Liabilities

Contingent liabilities are potential obligations that depend on future events. For example, if a company faces a lawsuit, the liability would only be recognized if it is likely the company will lose and can estimate the financial impact.

Understanding these components helps clarify how they appear in financial statements and why net liabilities are critical for stakeholders assessing a company's financial health.

How net liabilities are reported in the UK

In the UK, companies are required to prepare and file financial statements, including a balance sheet, with Companies House. The balance sheet gives a snapshot of the company’s financial position, detailing its assets, liabilities, and equity (shareholders' funds).

UK companies adhere to accounting standards set by the Financial Reporting Council (FRC), typically following UK GAAP (Generally Accepted Accounting Practice) or IFRS (International Financial Reporting Standards). Under both frameworks, net liabilities are calculated and usually appear near the bottom of the balance sheet. Key sections commonly highlighted in financial statements include:

- Creditors: amounts falling due within one year: Short-term liabilities that need to be paid soon.

- Creditors: amounts falling due after more than one year: Long-term liabilities due over a longer timeframe.

- Called up share capital and reserves: These are components of equity, reflecting the company’s ownership structure.

Understanding how net liabilities relate to equity is crucial, as this connection offers valuable insights into a company’s financial resilience and overall stability.

How does net liability relate to equity

Net liabilities are closely tied to equity, as both reflect a company’s capital structure. Equity represents the owners' remaining interest in the company after liabilities have been subtracted from assets. Equity changes can be seen by looking at the profit and loss (P&L) statement, which shows the company’s income and expenses. Profits increase retained earnings and boost equity, while losses reduce them. This connects the company’s daily operations to its overall value.

In the UK, equity is often called shareholders’ funds or capital and reserves, which typically include:

- Called up share capital: The total amount shareholders have committed to invest

- Reserves: Accumulated retained earnings and other surplus funds

- Share premium account: Additional funds paid by shareholders above the nominal share value

The balance between net liabilities and equity offers insights into a company's capital structure and financial risk. A high level of liabilities and low equity may signal higher risk for investors and creditors. Conversely, a company with substantial equity is better positioned to absorb losses and may find it easier to secure financing.

The debt-to-equity ratio is a valuable metric for evaluating this balance, showing the extent of a company's reliance on debt relative to its equity. A high debt-to-equity ratio indicates heavy reliance on borrowing, which can elevate financial risk if debt repayment becomes challenging.

With a clearer picture of how net liabilities connect to equity, we can see why they are so crucial for assessing a company’s financial well-being and why they matter to different stakeholders.

Why net liabilities matter

Understanding net liabilities is important for several reasons. Here are some of the most significant:

Indicator of financial health

Net liabilities can indicate potential financial distress, suggesting that a company may lack sufficient resources to meet its obligations. This can serve as a warning sign for investors and creditors, prompting them to approach the company with caution.

Going concern assessment

UK companies are required to evaluate their status as a going concern, meaning they should be able to continue operations for the foreseeable future. High net liabilities can raise concerns about a company’s ability to remain operational, as they indicate potential challenges in meeting financial obligations.

Impact on Investor and Creditor Confidence

Companies with high net liabilities may find it more difficult to secure loans or attract investments. Creditors and investors often favor firms with net assets, as this reflects greater financial stability. Consequently, a company burdened with significant net liabilities might be perceived as riskier, leading to increased borrowing costs or challenges in raising capital.

Legal consequences

In the UK, if a company continues to operate while insolvent—meaning its liabilities exceed its assets and it cannot pay its debts—it can result in legal repercussions for its directors. Such consequences may include fines, penalties, or even disqualification from managing a business in the future.

When companies face high net liabilities, they must manage their debt wisely to avoid financial strain. Let’s explore some strategies they can use to handle debt effectively and maintain financial stability.

Debt strategies for companies facing net liabilities

Companies grappling with net liabilities have various strategies to enhance their financial situation. Here are some of the most common approaches:

Refinancing

This strategy involves replacing an existing debt with a new one that typically offers more favorable terms, such as lower interest rates or extended repayment periods. Refinancing can help alleviate the immediate financial pressure of debt repayment and improve cash flow.

Debt consolidation

Debt consolidation allows a company to merge multiple debts into a single loan. This simplifies debt management and often comes with lower interest rates, making it easier to handle repayments and concentrate on long-term debt reduction.

Hedging against interest rate exposure

Companies can mitigate the risk of fluctuating interest rates by employing financial instruments like interest rate swaps. An interest rate swap is a financial contract in which two parties agree to exchange interest payments on a specified principal amount. Typically, one party pays a fixed interest rate, while the other pays a variable interest rate. This arrangement can help a company stabilize its interest expenses. his helps manage the risk of rising rates, which could increase the cost of existing loans.

Debt-to-equity conversion

In certain situations, companies may negotiate with creditors to convert debt into equity. This approach reduces liabilities while giving creditors an ownership stake in the company, providing financial relief without incurring additional borrowing.

To put these concepts and strategies into perspective, let’s look at some real-world examples that demonstrate how companies manage their net liabilities and the resulting impact.

Example of Net Liabilities

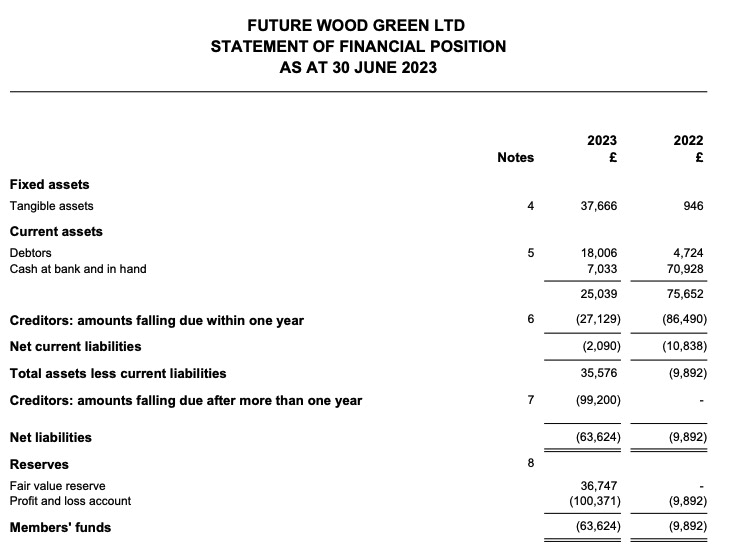

Let’s take a look at the balance sheet of Future Wood Green Ltd, a retail company, to illustrate the concept of net liabilities:

As of 30 June 2023, Future Wood Green Ltd reported net liabilities of £(63,624), as indicated in its Statement of Financial Position (Balance Sheet) above. This figure can be calculated using the following Net Liabilities formula:

Net Liabilities = Total Liabilities - Total Assets

Total Liabilities can be derived from:

- Creditors: amounts falling due within one year (£27,129)

- Creditors: amounts falling due after more than one year (£99,200)

- Total Liabilities = £126,329

Total Assets are calculated as follows:

- Fixed assets (£37,666)

- Current assets (£25,039)

- Total Assets = £62,705

Thus, the calculation for Net Liabilities is:

Net Liabilities: £(126,329) - £62,705 = £(63,624)

This indicates that Future Wood Green Ltd has net liabilities of £(63,624). Such a situation may suggest potential financial distress, as the company’s debts exceed its assets, which could pose challenges in meeting its obligations without effective debt management.

To further illustrate the relationship between net liabilities and equity, Future Wood Green Ltd reported equity (Shareholders’ Funds) of £(63,624) as of the same date. This highlights the financial risk stemming from a high level of liabilities relative to its assets, affecting the company’s overall capital structure. This relationship is crucial because equity reflects the residual interest in the company after all liabilities are settled.

While net liabilities are a key measure of financial health, they should not be considered in isolation. Let’s examine why a more comprehensive approach to financial analysis is advantageous.

Difference between net liabilities and net current liabilities

It’s essential to differentiate between net liabilities and net current liabilities, as they reflect distinct aspects of a company’s financial obligations.

-

Net liabilities encompass both current and long-term liabilities. This measure indicates the total amount by which a company’s liabilities exceed its assets, including all debts due in the short and long term. In essence, net liabilities provide a comprehensive view of the company’s overall financial position.

-

Net current liabilities, however, concentrate solely on short-term obligations. It is calculated as the difference between current liabilities and current assets. If current liabilities exceed current assets, the company has net current liabilities, suggesting it may face challenges in meeting its immediate financial obligations. This metric is a vital indicator of short-term liquidity and the company’s ability to settle debts in the near future.

For instance, in the balance sheet of Future Wood Green Ltd that we examined earlier, the company reports net current liabilities of £2,090, indicating that its short-term liabilities exceed its short-term assets. In contrast, its net liabilities stand at £63,624, revealing that the company’s overall liabilities significantly surpass its total assets, including both short- and long-term obligations.

Understanding the distinction between these two terms is critical for evaluating both short-term liquidity and long-term financial health.

Ultimately, while net liabilities provide valuable insights, they represent only part of a broader picture. In summary, let’s review why grasping the concept of net liabilities is vital for stakeholders.

Conclusion

In the UK, net liabilities are an essential metric for assessing a company’s financial stability. They represent the difference between a company’s debts and its assets, serving as a key indicator of financial health. While high net liabilities may suggest potential risk or financial strain, they don’t always indicate that a company is in trouble. Businesses frequently incur liabilities strategically to promote growth or manage capital more effectively.

To manage net liabilities effectively, companies can employ strategies such as refinancing, debt consolidation, and debt-to-equity swaps. Moreover, understanding the relationship between net liabilities and equity provides valuable insights into a company’s capital structure and risk profile.

For investors, creditors, and business owners, net liabilities are just one component of the overall financial picture. By evaluating them alongside other financial metrics—such as the debt-to-equity ratio and working capital—stakeholders caan gain a more comprehensive understanding of a company’s financial health and long-term prospects.