Analysing a balance sheet is essential to understanding a company's financial health. But even seasoned professionals can make mistakes, especially when interpreting balance sheets under UK accounting standards.

Below, we explore the most common mistakes and provide practical guidance on how to avoid them.

1. Ignoring the classification of liabilities

Liabilities are one of the key components of any balance sheet. They are split into two categories:

Current liabilities (due within one year)

Non-current liabilities (due after one year)

Failing to differentiate between these can lead to a misinterpretation of the company’s financial stability.

For instance, a company with significant non-current liabilities may appear heavily indebted and struggling to meet its obligations. But the obligations from non-current liabilities are spread over several years. This means that they may not pose an immediate threat to liquidity. Analysts should evaluate both the timing and nature of liabilities to gain an accurate picture of the company’s financial health.

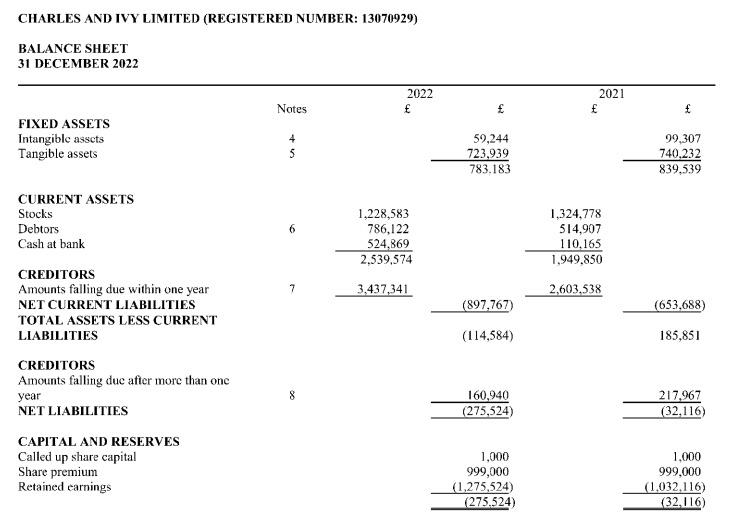

Example

Let’s look at the financial statement of Charles and Ivy Limited as of 31 December 2022. This UK-based company is in the manufacturing sector. Its balance sheet shows both current and non-current liabilities. These separate classifications of liabilities are both crucial in understanding the company’s financial health.

On the balance sheet, Charles and Ivy Limited list:

- Current liabilities (due within one year) of £3,437,341. This includes amounts like trade creditors, bank loans, and other immediate debts.

- Non-current liabilities (due after one year) of £160,940, reflecting long-term obligations.

The total liabilities amount to £3,598,281, of which £3,437,341 are immediate short-term obligations.

Not considering the distinction between these categories could give an incorrect impression of the company’s financial stability. For instance, while the company has significant liabilities, much of it needs to be settled within the next year. This could create short-term liquidity pressure.

2. Misinterpreting ‘cash at bank and in hand’

In UK financial statements, the term cash at bank and in hand refers specifically to the physical cash held by the company and money in its bank accounts.

This is different from the broader term cash and cash equivalents. Some analysts mistakenly assume these include near-cash items such as marketable securities or short-term investments.

This misunderstanding can lead to an overestimation of a company's liquidity. If cash at bank and in hand is misinterpreted as including other liquid assets, analysts may believe a company has more available cash than it does.

Understanding exactly what is included in the cash figure is crucial for assessing a company’s ability to meet short-term financial obligations.

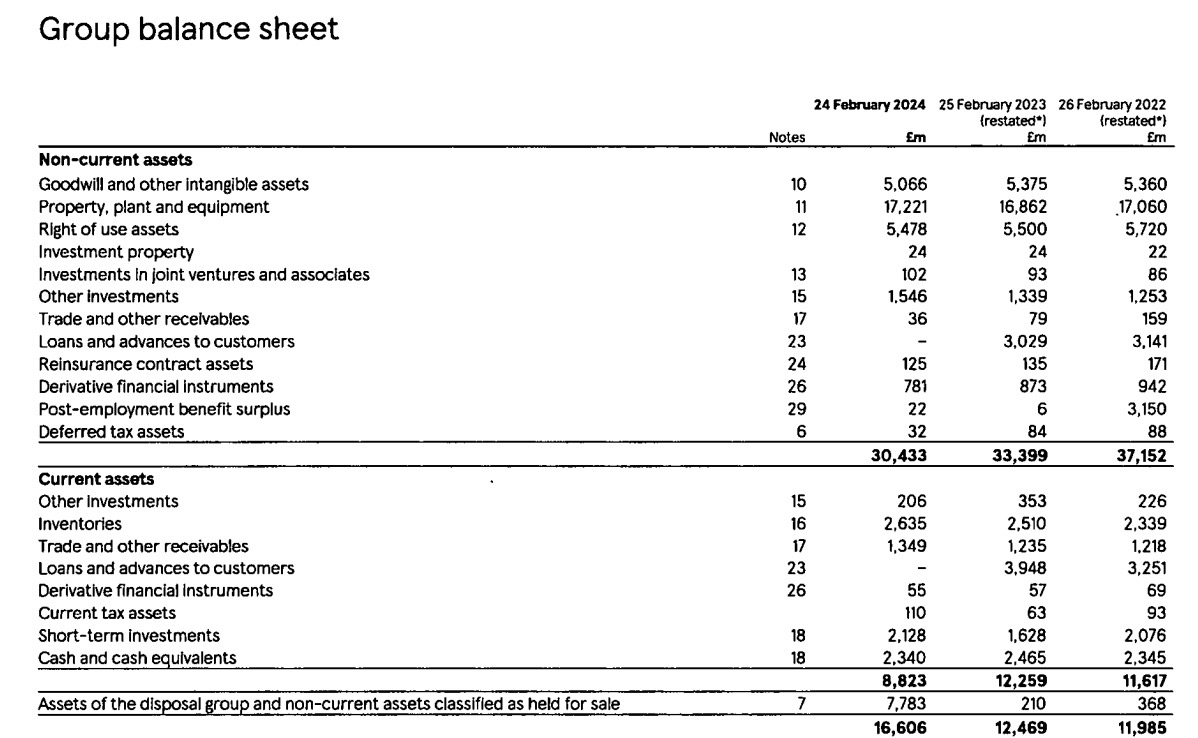

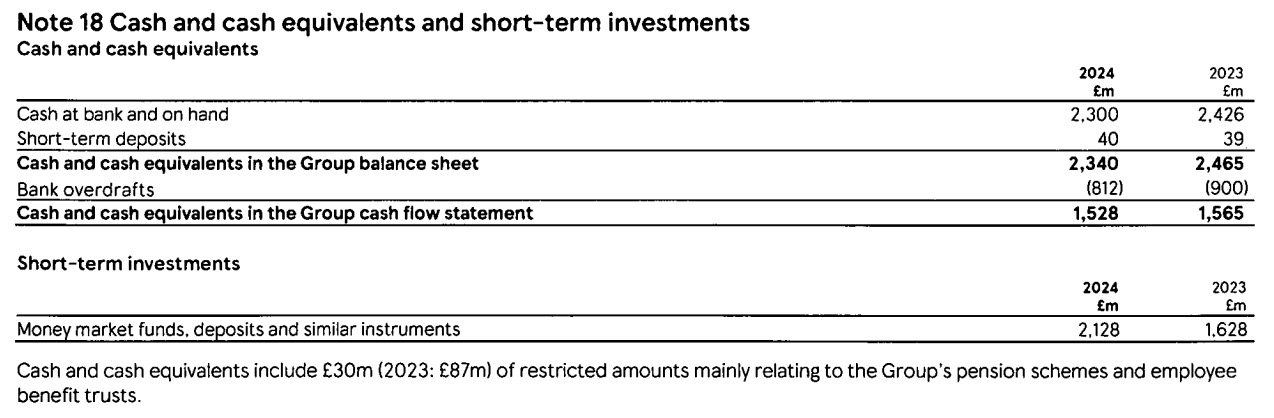

To illustrate the common mistake of "Misinterpreting 'Cash at Bank and In Hand'", we can look at the financial statements of Tesco Plc, one of the largest retailers in the UK. In the 2024 financial year, Tesco reports £2,340 million in cash and cash equivalents.

Note 18 of the report breaks down the £2,340 million in cash and cash equivalents, which includes:

- £2,300 million in cash at bank and on hand. This represents the actual cash Tesco holds in its bank accounts and physical cash reserves.

- £40 million in short-term deposits. These are highly liquid but are not classified as investments.

It's important to note that cash at bank and on hand refers strictly to immediately accessible cash. It does not include other liquid assets like short-term investments.

Tesco’s short-term investments are reported separately, amounting to £2,128 million in 2024. These investments can usually be quickly converted into cash, but they are not part of the cash and cash equivalents figure shown on the balance sheet. They carry slightly more risk and are not quite as liquid as cash at bank and on hand. Not presenting these separately would misrepresent the true cash position and ability for the company to meet its immediate obligations.

3. Overlooking working capital

Working capital is an essential measure of a company's short-term financial health, yet it is often misunderstood.

Working capital is the difference between current assets (inventory, receivables, cash. etc) and current liabilities (short-term debts, taxes owed, etc). Focusing on either current assets or liabilities alone without considering their balance can distort analysis.

For example, a company with substantial current assets but even larger current liabilities could face liquidity issues, despite appearing asset-rich if only current assets are considered. Conversely, a company with low current assets and liabilities may have a tight but manageable cash flow, because the working capital may be positive.

Accurate working capital analysis provides insight into the company’s short-term operational efficiency.

4. Not understanding net current assets

A closely related concept to working capital is net current assets. This reflects a company's ability to cover its short-term liabilities using its current assets. Failing to properly assess this can lead to incorrect conclusions about a company’s operational efficiency.

For example, large inventory levels on the balance sheet might look impressive, but might suggest operational issues. If the inventory isn’t moving, it signals there may be issues with sales or overproduction.

Analysts should focus on both the value and turnover of assets to avoid an inflated sense of financial security. This analysis could be done through a deeper analysis of the balance sheet, sales, and calculation ratios like the turnover ratio.

5. Misreading depreciation and asset valuation

A common mistake in balance sheet analysis is misinterpreting the impact of depreciation and asset valuations.

Under UK accounting standards, fixed assets are typically recorded at cost minus depreciation. In some instances, this can significantly undervalue assets. For example, property or equipment that may have appreciated over time.

This conservative approach can sometimes provide a misleading view of a company's asset strength. Alternatively, companies may not update asset values frequently enough, leading to outdated valuations on the balance sheet.

Understanding how asset values are calculated and whether they reflect the true market value is crucial.

6. Failing to consider contingent liabilities

Contingent liabilities are potential obligations that may arise depending on future events. For example, legal claims or guarantees.

Contingent liabilities are usually disclosed in the notes to the financial statements, rather than on the balance sheet itself, making them easy to overlook.

Failing to consider contingent liabilities can lead to an incomplete understanding of a company’s risk exposure.

For example, a company may seem financially stable but face significant legal risks that could impact future profitability.

Thoroughly reviewing the notes to the financial statements can reveal these potential liabilities and their impact.

7. Neglecting equity changes

In UK accounting, analysts often focus too heavily on just share capital and retained earnings when evaluating a company's equity section. However, this narrow approach overlooks other significant elements like the share premium account, capital redemption reserve, and revaluation reserve. These are all part of the company's equity and can significantly affect its financial standing.

- The share premium account reflects the amount shareholders paid for shares above their nominal value. It can represent a large portion of equity, especially for companies that have issued shares at a premium, boosting their financial reserves without increasing share capital.

- The capital redemption reserve arises when a company buys back its shares or redeems its preference shares. This reserve is legally required to protect creditors by ensuring that equity is not depleted through share buybacks, thus contributing to the company’s financial health.

- The revaluation reserve accounts for increases in the value of a company’s assets, such as property or equipment, when they are revalued upwards. This reserve indicates unrealized gains and reflects the current market value of assets, even if they haven't been sold. Devaluations can also cause the reserve to go down. If there are insufficient reserves then a devaluation will be reflected in the income statement as an expense.

For example, a company may have minimal share capital, but if it has significant revaluation reserves or a substantial share premium account, it might actually be in a much stronger financial position than it appears based solely on share capital and retained earnings.

Ignoring these reserves can lead to an underestimation of the company’s true equity value and financial strength.

8. Confusing profit and loss reserves with cash

It is a frequent mistake to equate profit and loss reserves with cash reserves. Just because a company reports large retained profits does not mean it has an equivalent amount of cash on hand.

Retained profits can be reinvested in the business or used to pay down debt, so assuming these are readily available funds can be misleading.

Understanding how retained profits have been utilised is crucial to assess a company’s cash position and available equity accurately.

9. Misunderstanding deferred tax assets and liabilities

Deferred tax items arise due to differences between tax reporting and accounting profits. Many analysts incorrectly assume that deferred tax assets are always recoverable or fail to account for the future impact of deferred tax liabilities.

Deferred tax assets are only beneficial if the company is profitable in future years, while deferred tax liabilities may indicate future tax obligations. Careful assessment of these items helps avoid overstating or understating a company’s future tax position.

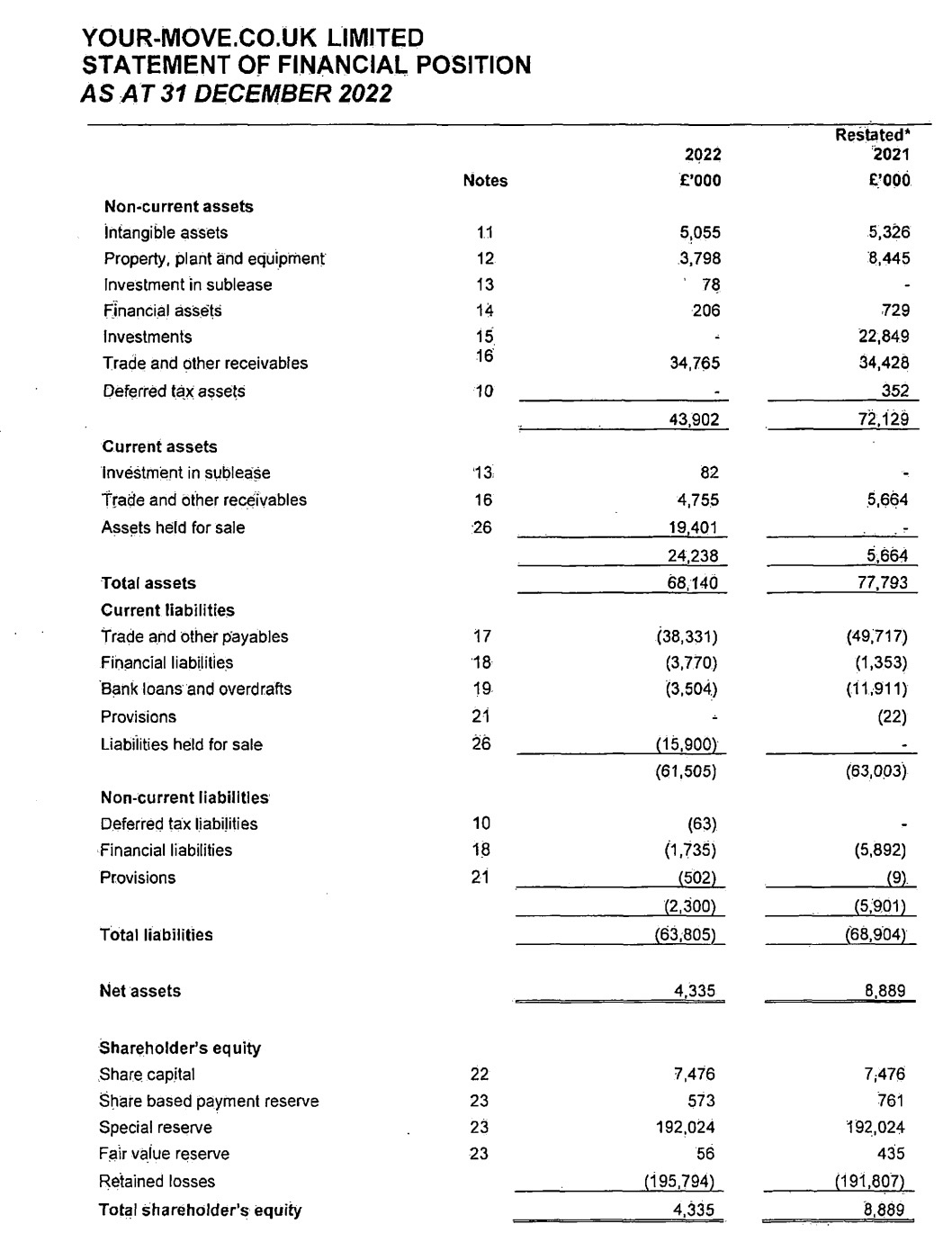

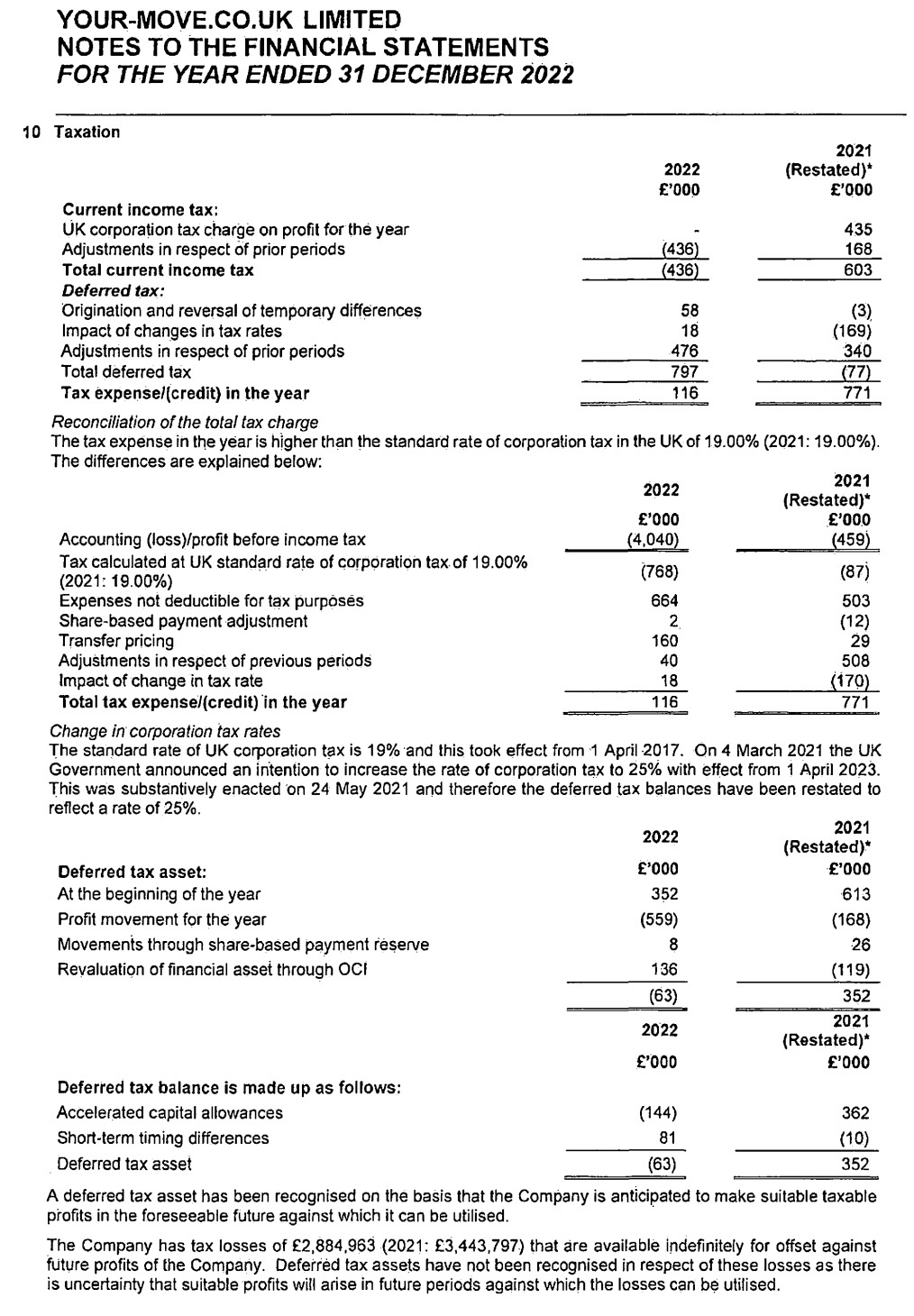

Example: Your-Move.co.uk Limited

Your-Move.co.uk Limited is a UK-based real estate agency that provides property services such as residential sales and lettings, property management, and mortgage services. In the company’s financial statements for the year ending 31 December 2022, we can see deferred tax assets and liabilities in action.

According to Note 10, Your-Move.co.uk Limited reported a deferred tax liability of £63,000 for 2022 (compared to a deferred tax asset of £352,000 in 2021). This amount reflects future tax obligations (expected tax benefits in 2021) the company expects, based on certain timing differences between accounting and tax treatment of expenses.

However, the report notes that the company has tax losses of £2.88 million (2021: £3.44 million), which can be used to offset future taxable profits. Yet, deferred tax assets haven’t been fully recognised because there’s uncertainty about whether the company will generate enough profits in the near future to benefit from these assets or settle the liabilities.

This highlights a common issue: deferred tax assets only have value if the company is expected to turn profitable. Otherwise, recognising these assets could lead to an overstatement of the company's financial position.

The deferred tax assets and liabilities seen in Your-Move.co.uk Limited's financial statements illustrate that analysts must carefully consider whether a company is likely to generate sufficient profits to recover these assets or pay the liability. Failing to do so can create an unrealistic view of the company’s future tax benefits or obligations, leading to a distorted understanding of its financial health.

10. Overlooking foreign currency translation differences

For companies with international operations, foreign currency translation is an important factor that can significantly affect financial reporting. When assets, liabilities, or revenues are held in foreign currencies, exchange rate fluctuations can impact their value when converted into the company’s reporting currency, typically GBP.

Ignoring these fluctuations can lead to misinterpretation of financial trends. For example, a company may report strong revenue growth in a foreign market, but if the local currency has weakened against the pound, those revenues might appear lower when translated into GBP. This can create a misleading picture of the company’s performance.

Similarly, foreign assets may decrease in value due to exchange rate changes, even if their value remains stable in the local currency. Analysts must closely monitor the effects of foreign currency translation on both the income statement and balance sheet to ensure an accurate understanding of a company’s financial health.

Multinational companies can experience significant swings in financial metrics due to currency movements, and failing to account for these differences can lead to poor decision-making.

11. Overlooking fair value adjustments

Certain assets, such as financial instruments or investment properties, may be reported at fair value under UK GAAP (FRS 102). These values fluctuate based on current market conditions, which can have a significant impact on the balance sheet.

Failing to account for these adjustments can lead to a distorted view of the company’s financial standing. This is especially true in volatile markets. Analysts need to scrutinise the assumptions used in fair value calculations and consider the implications in regard to the company's overall asset value.

12. Failing to consider group structures

For companies with complex group structures, consolidated financial statements can be difficult to interpret.

Minority interests, intra-group transactions, and other complexities may lead to confusion, especially when subsidiaries operate in different industries or geographic locations.

Understanding how these entities are consolidated is critical. For example, the balance sheet might include assets and liabilities of subsidiaries that are not wholly owned, and this can distort the financial analysis if not properly understood.

13. Neglecting to cross-reference with other financial statements

A common mistake is analysing the balance sheet in isolation.

Combining insights and cross-referencing the balance sheet with the income statement and cash flow statement allows for a holistic view of financial performance, stability, and future prospects. This offers a more accurate and nuanced understanding of a company’s overall financial health.

For example, a company with a strong balance sheet might show signs of declining profitability in its income statement. Or liquidity issues may be apparent in the cash flow statement. Only by reviewing all three financial statements can an accurate assessment be made.

All financial statements are interrelated: the cash balance reflected on the balance sheet can be reconciled through the cash flow statement, showing how operating, investing, and financing activities led to changes in cash.

Net income from the income statement affects retained earnings on the balance sheet, which in turn impacts shareholder equity.

The balance sheet’s current assets and liabilities can be analysed alongside the cash flow statement to understand the company's working capital management and liquidity.

Ratios can also be used with figures from the balance sheet and income statement to assess liquidity. For example, sales and inventory balances can be used to assess turnover of inventory.

The balance sheet shows the amount of debt, while the income statement includes interest expenses that need examination against operating profits to assess financial leverage.

Investments in long-term assets (seen on the balance sheet) are often detailed in the cash flow statement, which shows how much cash was used to acquire those assets.

14. Failing to consider industry-specific factors

Different industries have unique accounting treatments and balance sheet structures.

Applying a one-size-fits-all approach to analysis without considering industry norms can lead to faulty conclusions. For example, inventory plays a crucial role in retail, while contract assets are essential in the construction industry.

Applying generic financial ratios and benchmarks can lead to misleading conclusions. For example, a low inventory turnover ratio might indicate inefficiency in retail but could be standard in industries with long production cycles.

Important industry-specific metrics like order backlogs in construction or daily active users in tech may be ignored, undermining the analysis.

Understanding industry-specific factors is crucial for accurate balance sheet analysis and making meaningful comparisons. Each industry has distinct characteristics that affect financial structures and accounting treatments. Analysts must tailor their approach, recognizing key metrics and standards relevant to the industry, to ensure meaningful and accurate financial assessments. This nuanced approach helps avoid pitfalls and leads to more informed decision-making.