In the UK, a “charge” is essentially a promise a company makes, saying, “I swear on my office furniture and coffee machine that I’ll pay you back.” If the company needs a loan, the lender might register a charge against the company’s assets, just in case things go south. And if the company doesn’t keep up with payments? Well, the lender could be eyeing that fancy espresso machine or those high-tech laptops as collateral.

Charges need to be registered with Companies House to be legally enforceable, making them a key player in the business-lender drama.

Let’s dive into what charges are, the different types, and how the whole process works.

Understanding the different types of charges

Before a charge can be registered, the company has to whip up a charge instrument—like a mortgage deed or some other official-looking document that creates the charge. This document spells out all the gritty details of the loan, including exactly what’s on the table as security. To make it all legit, a certified copy of this instrument has to hit Companies House within 21 days, where it joins the public record and can proudly declare, “I’m legally enforceable!”

Now, let’s talk types of charges:

- Fixed Charges: Think of this as the lender saying, “Hands off my property!” Fixed charges are tied to specific, long-term assets—like a property, fancy machinery, or even company cars. If a company takes a loan to buy a warehouse, for example, the lender may place a fixed charge on that shiny new warehouse. And if payments aren’t made, the lender gets the keys.

- Floating Charges: This is where things get interesting. A floating charge hovers over assets that, well, don’t sit still—like inventory, cash, and raw materials. These charges float over a company’s shifting assets and only “crystallize” into something more serious if the company defaults or goes belly-up. Imagine using your stock as security; if things go south, the lender swoops in and takes whatever stock is left on the shelves.

- Negative Pledge: This one’s like the lender saying, “No sharing allowed!” A negative pledge stops the company from using the same assets to charm other lenders without permission. It’s the lender’s way of making sure they stay first in line if things get messy.

- Debentures: A debenture is a specific type of charge, usually incorporating both fixed and floating charges. It is a legal document that outlines the terms of the loan and the security provided by the company. Debentures allow companies to borrow money while offering security over both fixed and fluctuating assets.

Examples of charges on UK companies

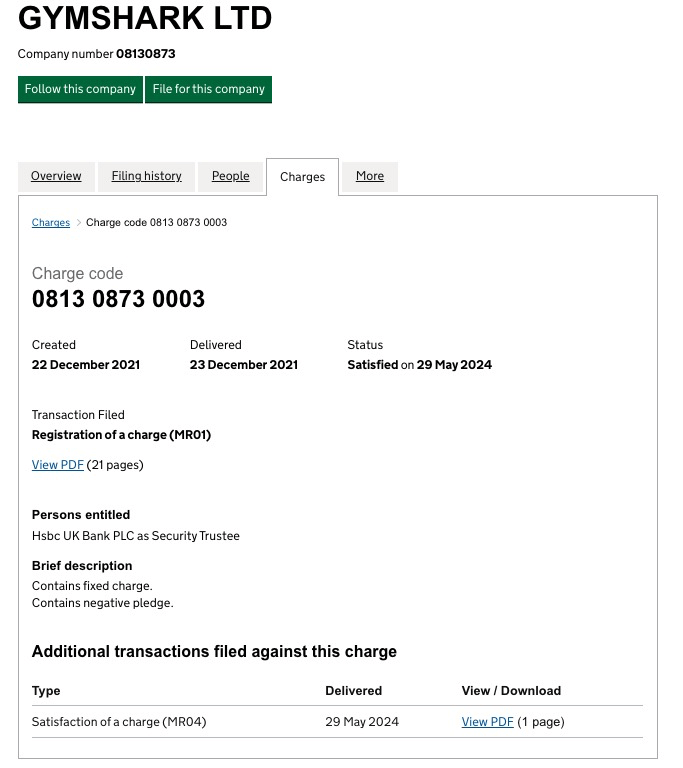

Example 1: Gymshark Ltd

On December 22, 2021, Gymshark Ltd, the fitness apparel retailer, registered a charge in favor of HSBC UK Bank PLC. This charge includes a negative pledge, which prevents Gymshark from using the same assets as collateral with any other lender without HSBC’s approval.

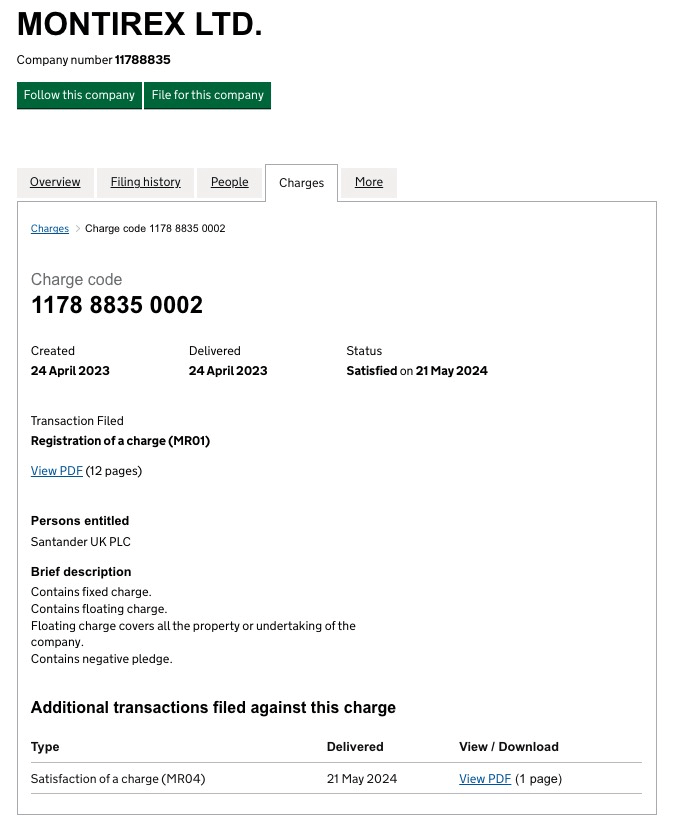

Example 2: Montirex Ltd

Companies sometimes combine various types of charges to secure different assets and obligations. For example, Montirex Ltd, a sportswear fashion retailer, registered a charge with Santander UK PLC on April 24, 2023, covering multiple asset types.

This charge from Montirex Ltd is a classic case of "let's keep everyone happy"—it’s got both fixed and floating charges, along with a negative pledge clause for good measure!

- Fixed Charge: This is like Montirex’s “please don’t touch” sign, securing specific assets of the company. It ensures that Montirex can’t just sell or transfer these precious items without giving Santander a heads-up first. No sneaky garage sales allowed!

- Floating Charge: This is where things get a bit wobbly! It applies to the company’s inventory or stock, which, much like a teenager's room, can change drastically over time. Montirex gets to keep using these assets in their day-to-day shenanigans, but if they trip up and default, Santander can swoop in and reclaim their treasure.

- Negative Pledge: Think of this as Montirex’s “no more borrowing from the same friends” clause. It prevents them from taking out any new charges on the same assets that would jump the queue ahead of Santander’s claim, ensuring that the lender stays snug and secure.

This example shows how companies like Montirex, juggling a mountain of inventory, can mix and match fixed and floating charges to keep their operations flowing smoothly while making sure lenders feel safe and sound. It’s all about balancing security with the freedom to keep selling those trendy sportswear pieces!

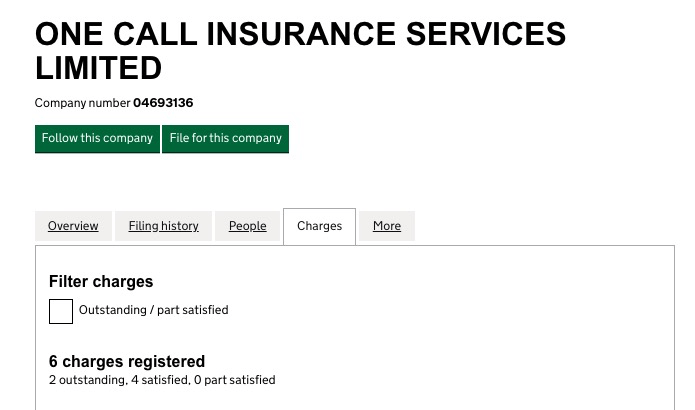

Example 3: One Call Insurance Services Limited

One Call Insurance Services Limited isn’t just any insurance company; they’re practically the overachievers of the charge world, with multiple charges registered at Companies House! It’s like they threw a party and invited all their creditors—everyone’s got a seat at the table.

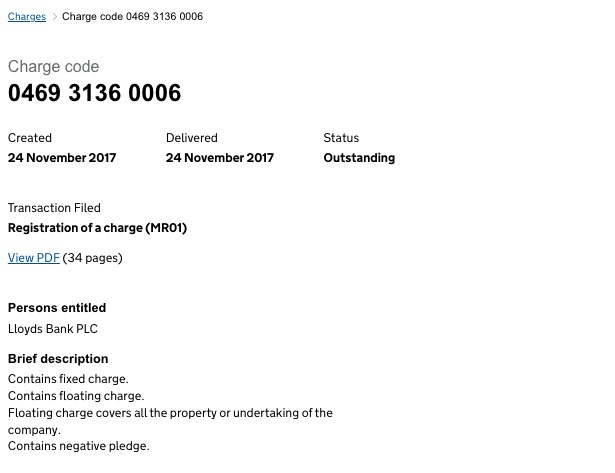

Take, for instance, their charge registered under charge code 0469 3136 0006, dated 24 November 2017, held by Lloyds Bank PLC. This isn’t your run-of-the-mill charge; it’s a fixed charge, meaning specific assets—think property or those ever-elusive cash deposits—are locked in tighter than a hipster's grip on their avocado toast, all to secure a loan or financial obligation.

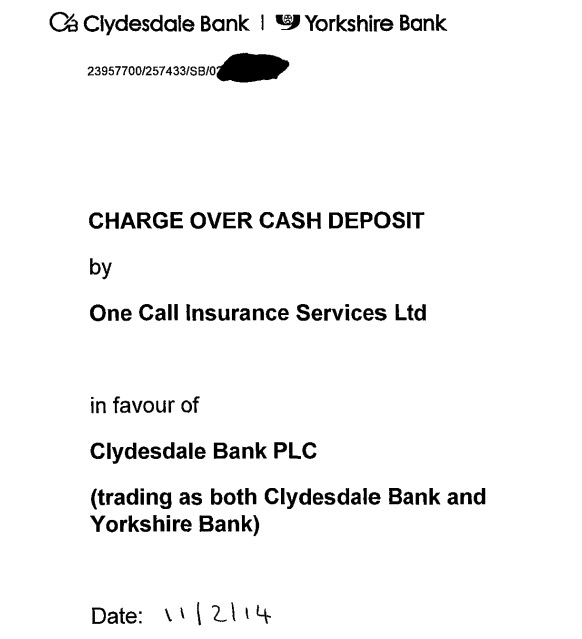

Now, let’s hop back to an earlier time: a charge from 11 February 2014, which is like a blast from the past. This one’s registered in favor of Clydesdale Bank PLC, and it’s got all the bells and whistles of a fixed charge over cash deposits.

Basically, it’s a detailed love letter to a specific bank account that One Call Insurance Services Limited has.

The terms are crystal clear: this deposit is there to secure all present and future obligations to the bank, including any liabilities that might pop up like a surprise party—nobody likes those, especially when they involve debt!

These charges give creditors the legal rights to the company’s assets in case things go south, acting like a financial security blanket for the lenders. And let’s not forget, registering these charges makes them legally enforceable and visible to other potential creditors, ensuring that everyone knows who the ‘favorite’ is. It’s a critical component in managing the company’s financial health, and let’s be honest, it keeps everyone on their toes!

The registration process

So, you've got a loan, and you're about to register a charge. But don’t just wing it—knowing the registration process is key to keeping that charge enforceable. Let’s break down this grand registration journey so you can cruise through it with style!

Step 1: Prepare the charge document

Alright, first things first—get that charge document ready. This is basically the legal version of a pinky swear that outlines the loan details and what the company is putting up as security. Think of it as the grown-up version of “I swear on my Pokémon cards that I’ll pay you back.”

Step 2: file the charge with Companies House

Now, the clock starts ticking! You have 21 days to submit this charge document to Companies House. They want all the juicy details, like:

- Your company’s name and number

- The date the charge was created

- A description of the charge and any assets involved

- The lender’s name(s)

And don’t forget, you’ve got options here—go digital with the online form (MR01), or keep it old-school with a paper form. Either way, you’ll need to include a fee (£15 at the time of writing) to make it official. Just think of it as Companies House charging you to charge them with charges.

Step 3: receive certificate of registration

Congrats, you’ve done it! Companies House will now send you a “Certificate of Registration of a Charge,” aka your official membership card to the Debt Club. This includes your charge code, company number, and charge creation date.

Step 4: stay on top of updates

So, what happens if you tweak the terms of the charge or (gasp) actually pay it off? Make sure to update Companies House, or they’ll still think you owe someone big time. Whether you’re extending the repayment term, adding more assets, or marking it “paid in full,” keep them in the loop. Otherwise, future lenders or investors might raise an eyebrow, wondering if you’re still in debt up to your eyeballs. No one wants a case of mistaken debt-entity.

Keeping everything up to date means your company looks transparent, trustworthy, and ready for its next financial fling.

Common mistakes when registering a charge

To keep your registration process running smoother than a hot knife through butter, let’s go over the classic blunders and how to dodge them like a pro:.

Missing the 21-day deadline

This one’s a biggie. The 21-day deadline matters a lot. Miss it, and the charge could be void against administrators, liquidators, or other creditors. Translation? Lenders may have to go all Judge Judy and head to court. So, mark your calendar, set a reminder, or tie a ribbon around your finger—whatever it takes to avoid this paperwork apocalypse.

Inaccurate documentation

Nothing kills the vibe like a typo. Incorrect or incomplete information on your charge document is basically handing Companies House a “Try Again” card. They’ll either delay or reject your registration faster than you can say “back to the drawing board.” So, double-check every detail, from the spelling of the company name to the charge amount, like you’re proofreading a love letter to your first crush. Accuracy is key to avoid embarrassing back-and-forth.

Failure to register charge satisfaction

Congratulations, you paid off the debt! Now, let Companies House know by marking the charge as “satisfied.” If you don’t, it’s like leaving an “Occupied” sign on an empty bathroom stall—confusing and frustrating for anyone looking in. Plus, it might look to future lenders like your company is still weighed down with debt. So don’t leave ‘em guessing—officially clear your record and keep your financial slate as squeaky-clean as your good name.

Who can register a charge?

In the UK, not just anyone can register a charge. It needs to be done by someone with a vested interest in the charge itself. Here’s who typically takes on this role:

- The Company Itself: The company can register a charge directly, usually through its officers, such as directors or other authorized representatives. This is common when a company is securing financing and wants to make the arrangement official.

- The Lender: Since the lender has a direct interest in ensuring their loan is secured, they may choose to register the charge. By doing so, they protect their claim on the company’s assets if repayments aren’t met.

- An Authorized Agent: Sometimes, a third party—like a solicitor or agent acting on behalf of either the company or lender—will handle the registration. This can streamline the process, especially if the parties are managing multiple charges or complex arrangements.

How charges determine who gets paid first in the case of bankruptcy?

When a company goes belly-up, creditors with registered charges are the VIPs, and the order of the “VIP list” matters a lot. Fixed charges are like the early birds—they swoop in first, grabbing assets before the floating charges even find their seats.

Proper registration is the golden ticket that makes sure these creditors keep their front-row privileges.

Charge priority: First dibs in the event of insolvency

Imagine a bunch of creditors with their hands up, yelling, “Me first!” over the company’s assets. Who gets to grab what? That’s where the order of registration comes in. Creditors who registered their charges early get first dibs—think of it as showing up first at the buffet table. If lenders don’t register their charges properly, they could find themselves at the back of the line, clutching an empty plate.

Impact of charges on a company: more than just debt on paper

Charges aren’t just a footnote in a company’s life; they’re like a neon sign for potential lenders and investors. Having registered charges can shape everything from credit ratings to future financing prospects. A common mistake when analyzing the P&L statement is focusing only on profit without understanding how charges and liabilities impact the company's actual financial health. This oversight can lead to a skewed view of a company’s stability and its ability to manage debt.

Impact on credit rating

When a charge goes on the books, credit rating agencies take note. A charge can be a double-edged sword: on one hand, it’s proof the company could snag a loan—score! But on the other hand, it signals they’ve got debts hanging over their head. If those debts add up to a significant net liability, it can weigh heavily on their balance sheet, impacting both credit rating and potential for future financing. Understanding a company’s balance sheet in this context is key—it reveals the ratio of assets to liabilities and shows creditors whether the company is on solid ground or sinking fast. Too many charges can make a company’s credit rating look shaky, especially if they’re struggling with repayments.

- Positive Side: If a company manages its debts like a pro, this might actually boost its image, showing off its ability to secure loans and meet deadlines.

- Negative Side: But if there are too many charges, or if the company starts missing payments, it’s like setting off an alarm for lenders. They might slap on higher interest rates or, worse, deny credit altogether.

Charges and small businesses: tiny assets, big impact

For small businesses, charges are like handing over the keys to the castle. With limited assets, a charge on something like property, equipment, or inventory can seriously cramp their style. Need to sell or move a piece of equipment? Sorry, gotta ask the lender for permission. It’s like having a nosy landlord for your assets.

- Advantages: Using a charge to secure a loan could mean lower interest rates, which is a rare win.

- Disadvantages: The downside? If cash flow gets tight, they might risk losing their most prized possessions. It’s a high-stakes game, where the price of losing could mean saying goodbye to the assets that keep their business running.

In short, charges can be both a lifeline and a leash. They might help secure financing, but they also come with serious strings attached—so if a company’s not careful, those strings could turn into a full-on financial chokehold.

Impact on future financing: why one charge could close the bank

Think of a charge like a big red flag waving in a lender’s face. When a company already has assets tied up in existing charges, lenders get nervous, seeing less available collateral to secure any new loans. It's like asking for a second helping of dessert while still holding the first—new lenders might say, “Finish what’s on your plate!” If lenders do offer financing, it’s likely to come with sky-high interest rates to cover their anxiety.

Multiple charges on assets? Now you’re practically scaring lenders away. They’ll assume the company is juggling debts like a circus act, and trust me, banks aren’t fans of the high-wire routine.

Operational & legal considerations of charges: small biz survival guide

For small businesses, charges can be a bit of a headache. Imagine you’ve registered a charge on your most crucial assets, and now it’s like asking for permission every time you want to touch, sell, or even dust them. Need to sell a machine to jump on a hot new trend? Better get the lender’s okay first.

That said, charges can be a blessing in disguise. Fixed charges might mean lower interest rates, which can feel like a cool breeze on a hot day. The trick is keeping a balance: enough flexibility to keep things moving, without tripping over those charges every step of the way.

Due diligence: Lenders do the detective work

When a company’s up for sale or attracting investors, charges are like the skeletons in the closet everyone’s looking for. Buyers want to know if there’s any “financial baggage” hiding in the company’s assets.

- Buyer Concerns: Charges can make buyers wary, like finding out your date has a mysterious “roommate” they won’t talk about. They’ll want to know all the details, and if the charge is too scary, they may ask the company to deal with it before signing any dotted lines.

- Negotiation Leverage: Buyers might use these charges as leverage, saying, “Well, with those strings attached, maybe the company isn’t worth quite that much...” It’s all part of the game.

Insolvency impact: The asset grab race

When a company goes under, it’s every creditor for themselves. Fixed charges are like VIP passes to the front of the line. These creditors get first dibs on the company’s assets, snapping up machinery and property faster than a Black Friday sale. Floating charges, on the other hand, are like general admission—great, unless there’s nothing left to claim.

And if insolvency hits, floating charges can “crystallise,” meaning they turn into fixed charges. But even then, they still rank below the original fixed charges. Moral of the story: fixed charges always get the best seats.

Why register a charge? Because legal rights are a lender’s best friend

So why go through the trouble of registering a charge? For lenders, it’s like marking their territory—without it, their rights to any assets could vanish faster than free coffee in the break room. No registration, no claim, and if the company defaults, the lender could be left empty-handed.

For companies, registering a charge shows transparency. It’s like saying, “Hey, we’re legit, we’re responsible, and we’re willing to play by the rules.” Future lenders, investors, and partners love that. So even if the paperwork is a pain, it’s worth it for the peace of mind—and to keep everything above board, just in case a financial storm rolls in.

Conclusion: Charge it right, keep it tight

Charges may sound like a big snooze-fest, but in the business world, they’re the secret sauce for securing loans. Knowing your charges—and keeping them properly registered—means you’re not only protecting assets but also keeping the law off your back. Think of it like putting a “Reserved” sign on your assets so creditors know exactly who’s got dibs.

For lenders, registering a charge is like getting VIP access. They don’t just want to lend money; they want to make sure they’ll get their hands on the company’s prized possessions if things go south. It’s peace of mind, with a side of “that’s mine.”

The process may feel like a never-ending maze of forms and deadlines, but by sticking to the steps and sidestepping the classic blunders, both companies and lenders can glide through the process and stay cozy with Companies House.

In short: charge responsibly, register smartly, and keep those assets under lock and key!