Analysing a company's Profit and Loss (P&L) statement, also known as the Income Statement, is crucial for understanding its financial performance. However, even experienced financial analysts can fall into traps when interpreting this vital document.

This article explores common mistakes to avoid when analysing P&L statements under UK accounting standards.

1. Overlooking the importance of revenue recognition

One of the most critical aspects of P&L analysis is understanding how and when revenue is recognised. Under UK GAAP (FRS 102) and IFRS 15, revenue recognition can be complex, particularly for companies involved in long-term contracts, subscription-based services, or multi-element arrangements. Companies may record revenue before cash is received, or the timing may not match up with the actual transfer of goods or services.

This approach aims to more accurately reflect the economic substance of the transaction and match revenue recognition with the delivery of goods or services to the customer over time.

- Common mistake: Assuming all recorded revenue represents cash received. Or assuming that all sales from contracts represent current year revenue. This revenue may need to be split out across more accounting periods if the contract states that work is to be done in later years.

- How to avoid it: Carefully review the company's revenue recognition policies in the notes to the accounts. Pay particular attention to any changes in these policies and how they might affect year-on-year comparisons. Industries like construction, software as a service (SaaS), and manufacturing are especially prone to complex revenue recognition issues due to long-term or bundled contracts.

2. Misinterpreting exceptional or non-recurring items

Companies often report exceptional or non-recurring items separately in their P&L statements.

Examples include:

- Gains from selling a significant asset

- Restructuring costs

- Large legal settlements

Such items can distort profitability presented in the current years P&L if not properly analysed.

- Common mistake: Taking these exceptional or non-recurring items at face value without scrutiny or, completely ignoring them.

- How to avoid it: Assess whether items labelled as "exceptional" truly are one-off events. Analyse their nature and frequency over several years. Consider the reported results when both including and excluding these items in your analysis to get a more accurate view of the company’s performance. Be cautious of companies labelling recurring or operational expenses as exceptional to artificially boost their bottom line.

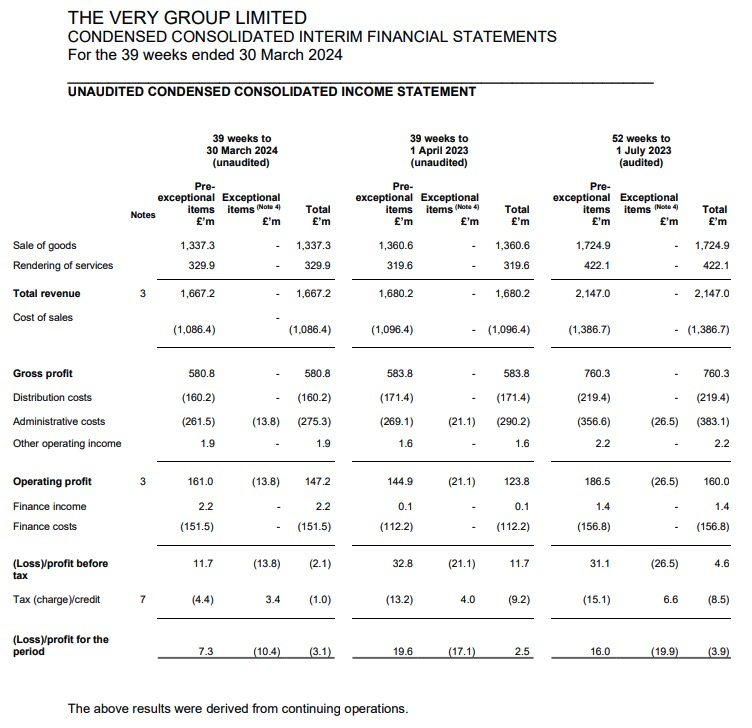

An example: The Very Group Limited

Let’s take The Very Group Limited as an example to illustrate the correct interpretation of exceptional items. The company is a major player in UK retail and financial services, running the popular online retail brand Very.co.uk.

In their interim financial statements for the 39 weeks ending 30 March 2024, The Very Group reported £13.8m of exceptional costs. These exceptional items are composed of several elements:

- £10.7m related to their ongoing technical transformation, where the company is shifting from on-premises technology to the cloud

- £1.2m in restructuring costs aimed at rationalising certain business processes

- £2.2m in professional fees tied to corporate projects

These are considered one-off or non-recurring costs and are classified as exceptional to prevent them from distorting the company’s core operating performance. This categorisation is important because it isolates the impact of strategic changes or rare events from the regular, ongoing business operations, giving stakeholders a clearer view of the company’s true financial health.

When analysing The Very Group’s performance, it’s crucial to consider the nature of these exceptional items. For instance, the technical transformation costs span multiple years, and while they are non-recurring, they do reflect a long-term strategic shift, which means that they will impact the company’s financial statements over several periods.

This example illustrates why it's essential not to ignore or take exceptional items at face value. By separating these costs, The Very Group provides a more accurate picture of its day-to-day profitability, but analysts should also consider these items in the broader context of the company’s financial strategy.

3. Neglecting the impact of accounting policy changes

Changes in accounting policies can significantly affect P&L figures, making it difficult to compare financial performance across periods.

Some examples could include:

- Changes in the way depreciation is calculated

- Changes in revenue recognition

- Changes in how inventory is valued

It's easy to overlook how these changes can affect the numbers, but they can make a big difference.

- Common mistake: Failing to adjust for accounting policy changes when comparing financial performance over different periods.

- How to avoid it: Always check for any changes in accounting policies in the notes to the accounts. UK GAAP and IFRS require companies to disclose these changes. Look for restated comparative figures or calculate the impact yourself to ensure like-for-like comparisons.

4. Misunderstanding the treatment of research and development (R&D) costs

The treatment of R&D costs can vary significantly, depending on whether they meet the criteria for capitalisation under UK accounting standards.

Capitalising costs means spreading the expense over time, while expensing them immediately will affect the current P&L.

- Common mistake: Assuming all R&D costs are either expensed immediately or all are capitalised.

- How to avoid it: Review the company’s policy on R&D expenditure.

Under FRS 102 (Section 18), R&D costs that meet specific criteria, such as those providing future economic benefits, can be capitalised.

It’s crucial to understand whether the R&D costs in the accounts are being expensed upfront or capitalised over future periods, as this impacts both short-term profitability and long-term asset values.

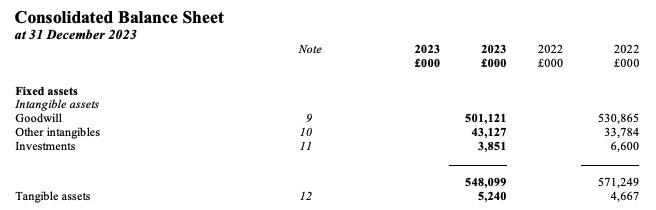

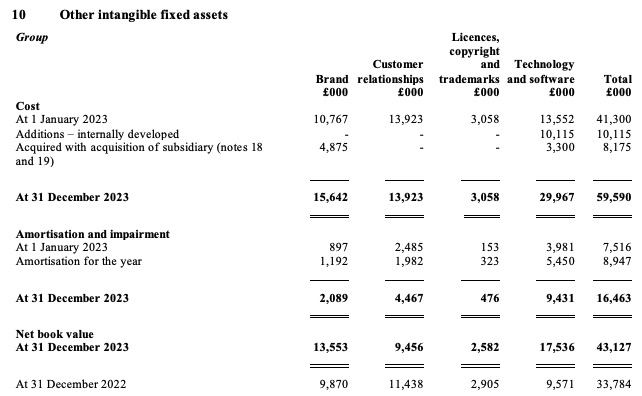

Example: Dragon UK Holdco Limited

Let’s take Dragon UK Holdco Limited, a provider of supply chain compliance and business certification services through its brand Alcumus, as an example of how Research and Development (R&D) costs are treated in financial statements.

In its financial report for the year ending 31 December 2023, Dragon UK Holdco Limited outlined its R&D activities aimed at developing new products and enhancing existing technologies. The company's R&D expenditure is treated in two ways:

- Expensed in the profit and loss account if the research does not meet capitalisation criteria.

- Capitalised as an intangible asset if the development meets specific criteria under UK accounting standards (FRS 102, Section 18). In this case, Dragon UK capitalises costs when it is expected that future economic benefits will arise from the project.

For the year 2023, as shown in the Notes to the financial statements, the company capitalised £10.1 million of internally developed software costs, which are recognised as intangible assets on the balance sheet. The total gross value, before amortisation, of other intangible assets, including customer relationships, licences, and software, amounted to £59.6 million as of 31 December 2023.

Due to the amortisation process, the net book value of these intangible assets, after deducting accumulated amortisation, stands at £43.1 million (with £9.4 million being attributed to technology and software).

The amortisation of these intangible assets helps spread the R&D costs over several years, reflecting the long-term benefits the company expects from these developments. For example, the amortisation charge related to technology and software was £5.5 million for the year. This ensures that the company's profit and loss statement isn’t fully burdened by these expenses in the year they were incurred, which helps maintain a more balanced and accurate reflection of the company’s financial performance.

Had these R&D costs been expensed immediately, they would have significantly increased the company’s reported loss for the year, making it difficult to assess the ongoing operational profitability of Dragon UK Holdco Limited.

5. Overlooking the impact of foreign currency fluctuations

For companies with international operations, currency fluctuations can significantly impact the P&L by affecting both revenues and costs. Exchange rates can distort the true operational performance of a company.

- Common mistake: Failing to consider the effect of exchange rate movements on revenue and costs.

- How to avoid it: Look for disclosures on foreign currency impacts in the notes or management commentary. Analyse the company’s performance in constant currency terms (excluding exchange rate fluctuations) to understand underlying trends. Additionally, be aware of the impact of foreign currency hedging or translation differences in other comprehensive income.

6. Misinterpreting gross profit margins

Gross profit margins provide insights into a company's pricing power and cost management. However, they require careful interpretation.

- Common mistake: Making simplistic comparisons of gross margins without considering industry norms or company-specific factors.

- How to avoid it: Analyse gross margins within the context of the company’s industry, business model, and historical trends. For example, retail companies may have lower margins than software firms. Be aware that different companies can categorise costs differently, which can affect margin calculations.

7. Neglecting the importance of operating expenses

While revenue and gross profit often receive the most attention, operating expenses – such as salaries, rent, and administrative costs – are crucial for understanding a company’s efficiency and profitability. These expenses determine operating profit, which reflects the company’s ability to control its day-to-day costs.

- Common mistake: Focusing solely on top-line growth without considering changes in operating expenses.

- How to avoid it: Analyse operating expenses as a percentage of revenue over time. Look for explanations in the management commentary or notes regarding significant changes. Rising operating expenses without a corresponding increase in revenue can signal inefficiencies, while a steady or declining expense ratio suggests operational efficiency.

8. Misunderstanding share-based payments

The treatment of share-based payments under UK accounting standards can be complex and significantly affect reported profits, especially for companies that use share options as a form of compensation for employees or executives.

- Common mistake: Overlooking the non-cash nature of share-based payment expenses or failing to understand their impact on earnings per share (EPS).

- How to avoid it: Carefully review the notes related to share-based payments. Under IFRS 2 and FRS 102, these are measured at fair value on the grant date and can dilute EPS. Understand how these payments are being accounted for and whether they have a significant effect on profitability, especially in tech or startup environments.

9. Failing to consider the quality of earnings

Not all profits are created equal, and the quality of earnings is as important as their quantity. Some companies may boost short-term profits through non-operational means, such as selling assets or accounting tricks.

- Common mistake: Focusing solely on bottom-line profit figures without considering their sustainability or quality.

- How to avoid it: Analyse the components of earnings. Look at the relationship between profit and cash flow from operations. Sustainable earnings are backed by consistent cash generation, not just accounting adjustments. High-quality earnings are typically characterised by strong operating cash flow aligned with profits.

10. Overlooking segment reporting

For companies with diverse operations, segment reporting offers crucial insights into the performance of individual business units, which may have different growth, profitability, and risk profiles.

- Common mistake: Analysing only the consolidated P&L without considering segment-level performance.

- How to avoid it: Thoroughly review segment reporting disclosures, which are required under IFRS 8 or FRS 102.

Analyse trends and profitability for each significant segment, especially if the company operates in different industries or geographic regions.

Segments with declining performance may signal trouble, even if the overall company seems profitable. Better financial decisions can be made with this segmented data, as it may lead to closures of certain branches or more investment in growing segments.

11. Misinterpreting finance costs

The treatment of finance costs, particularly for companies with complex debt structures, can be nuanced. This includes both the interest expense on debt and any capitalised interest related to long-term projects.

- Common mistake: Overlooking the impact of capitalised interest or failing to consider the full cost of debt.

- How to avoid it: Review the notes related to borrowings and finance costs, which are required under IFRS 9 or FRS 102. Understand that capitalised interest, which is added to the cost of an asset instead of expensed, can reduce reported finance costs in the short term but will increase depreciation or amortisation later on. Consider the full cost of financing by looking at both expensed and capitalised amounts.

12. Neglecting to cross-reference with cash flow statements

The P&L alone doesn’t tell the full story of a company’s financial health. The cash flow statement provides crucial context for understanding how profits translate into actual cash flow.

- Common mistake: Analysing the P&L in isolation without considering cash flow implications.

- How to avoid it: Always cross-reference P&L analysis with the cash flow statement. Look for discrepancies between reported profits and cash generated from operations. For example, a company may show high profits but poor cash flow due to issues like delayed receivables or unsustainable working capital.

13. Confusing revenue with profit

This is one of the most basic accounting principles. High revenue (turnover) does not necessarily mean a company is profitable. A business can generate significant revenue but still be unprofitable if its expenses – such as cost of goods sold, operating costs, interest payments, or taxes – are too high. It’s important to focus on net profit (bottom line), which reflects what’s left after all costs are deducted from revenue, to truly assess a company’s profitability.

- Common mistake: Assuming that high revenue equals high profit.

- How to avoid it: Focus on net profit (bottom line) after all costs and expenses have been deducted. High revenue is only valuable if a company is efficiently controlling costs and turning revenue into profit.

14. Failing to identify trends

One-off P&L statements provide a snapshot, but true financial analysis requires identifying trends over time.

- Common mistake: Focusing on a single P&L period without looking at historical performance. Making operational decisions on that financial data without considering trends.

- How to avoid it: Compare the P&L across multiple periods to identify patterns. Analysing trends can reveal long-term financial health issues that may not be apparent from a single period. Use multi-year comparisons to track metrics like gross margin, operating expenses, and profit growth.